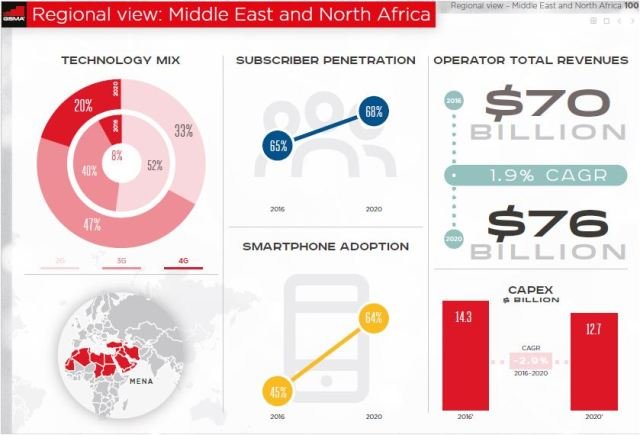

GSMA has predicted that mobile operator revenue in the Middle East and North Africa will increase to $76 billion in 2020 from $70 billion in 2016 – at a CAGR of 1.9 percent.

GSMA has predicted that mobile operator revenue in the Middle East and North Africa will increase to $76 billion in 2020 from $70 billion in 2016 – at a CAGR of 1.9 percent.

Capex (capital expenditure) of telecom operators in the Middle East and North Africa will drop to $12.7 billion in 2020 from $14.3 billion in 2016.

GSMA noted that there is wide diversity in smartphone take-up, with the rich Gulf States, Turkey and Israel well ahead of North Africa.

4G adoption is uniformly lower, but network investment is increasing at pace. This means there is upside from the increased data usage and ARPU uplift that should come from 3G to 4G migration.

Turkcell, a leading telecom operator in Turkey, is growing revenue at 21 percent, with digital ow 18 percent of domestic revenues.

Share of mobile phone owners that access the internet in the Middle East and North Africa will grow to 72 percent in 2020 from 60 percent in 2016.

Share of mobile phone owners that access the internet in the Middle East and North Africa will grow to 72 percent in 2020 from 60 percent in 2016.

Almost 1 billion more people will start using their mobiles to access the internet by 2020. By this time, five-sixths of phone owners globally will be mobile internet subscribers. Asia Pacific will account for more than half of this growth, mostly in India and China. However, as a proportion of population, Africa will grow the fastest.

Economic growth in Sub-Saharan Africa slowed to its lowest level in 20 years during 2016 due to lower commodity prices and external shocks. Although the economic outlook for 2017 and beyond has improved, the regulatory environment remains challenging.

Economic growth in Sub-Saharan Africa slowed to its lowest level in 20 years during 2016 due to lower commodity prices and external shocks. Although the economic outlook for 2017 and beyond has improved, the regulatory environment remains challenging.

As a result, revenue growth will decline markedly from 2018.

African operators need to place a greater urgency on searching for new growth streams other than subscriber growth.

Most Africans are on 2G but this is changing; 3G/4G will account for 60 percent of connections by 2020 and 85 percent by 2025.

Meanwhile, Capex by telecom operators in sub-Saharan Africa will increase to $8.7 billion in 2020 from $8.1 billion in 2016 – at 1.9 percent CAGR.

Mobile operators’ revenue in sub-Saharan Africa will increase to $55 billion in 2020 from $44 billion in 2016 – at 7.4 percent CAGR.