Vodafone reported solid financial performance for the third quarter of fiscal 2026, with total revenue rising 6.5 percent year on year to €10.5 billion, supported by strong service revenue growth and the consolidation of Three UK and Telekom Romania assets. Germany remained Vodafone’s largest market, followed by the UK and Africa.

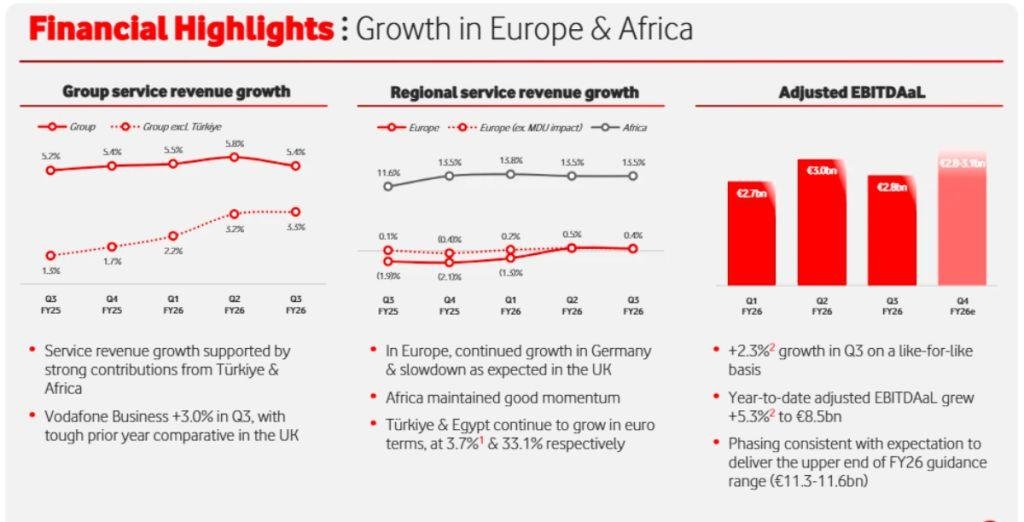

The telecom operator reiterated that it remains on track to deliver results at the upper end of its guidance range for both profit and cash flow for the fiscal year.

Service revenue growth led by Africa and Turkiye

Group service revenue increased 7.3 percent to €8.5 billion in the quarter. Vodafone said the consolidation of Three UK and Telekom Romania contributed to higher revenue, though foreign exchange movements partially offset gains.

Vodafone Group Chief Executive Margherita Della Valle said the company continues to see positive traction across its footprint.

“Looking ahead, we are on track to deliver at the upper end of our guidance range for both profit and cash flow,” Margherita Della Valle said.

Regional revenue breakdown

Vodafone’s geographic revenue mix highlights the importance of its European and African markets:

- Germany: €3,092 million

- UK: €2,441 million

- Other Europe: €1,509 million

- Turkiye: €823 million

- Africa: €2,208 million

Vodafone said the integration of its UK business is progressing well following the consolidation of Three UK. The company expects the integration to support efficiency gains and future growth.

Germany

Vodafone Germany reported stable performance in Q3 FY2026, with total revenue rising 0.1 percent to €3.1 billion as service revenue growth was offset by lower equipment sales.

Service revenue increased 0.7 percent, supported by higher wholesale revenue and strong demand for digital services in the Business segment, though mobile ARPU continued to face pressure due to competition. Growth improved sequentially, helped by higher mobile wholesale revenue.

Mobile service revenue grew 2.8 percent, driven by wholesale gains, while the migration of 1&1 customers to Vodafone’s network was completed. More than 12 million 1&1 customers now use Vodafone’s 5G network, with full revenue contribution expected in Q4 FY26.

Fixed service revenue declined 1.1 percent as TV headwinds persisted, partly offset by strong business digital services demand. Consumer broadband revenue stabilized after pricing actions in 2025, pushing ARPU from new broadband customers up 21 percent year on year. Additional broadband portfolio changes announced in January 2026 are expected to further support ARPU.

Vodafone Business service revenue fell 1.8 percent due to lower mobile ARPU and pressure in core connectivity services, despite strong demand for digital services. The acquisition of Skaylink in December 2025 is expected to accelerate growth in cloud, security and managed services.

Vodafone Germany added 42,000 consumer mobile contract customers despite intense competition, while connecting 2.6 million new IoT devices, mainly in the automotive sector. Broadband customers declined by 63,000 as the company prioritized value and ARPU growth. Vodafone continues to lead Germany’s gigabit connectivity market, reaching almost 75 percent of homes and expanding fibre rollout through its OXG joint venture. TV customers declined slightly as demand for standalone linear TV continues to fall, partly offset by bundling with broadband.

UK

Vodafone UK delivered strong headline growth in Q3 FY2026 following the consolidation of Three UK after the merger completed on 31 May 2025.

Total revenue rose 30.9 percent to €2.4 billion, while service revenue increased 31.1 percent. However, on an organic basis, service revenue declined 0.5 percent due to tough comparisons with the previous year, despite solid commercial momentum in Consumer and Wholesale segments.

Mobile service revenue jumped 42.8 percent. Fixed service revenue fell slightly by 0.2 percent. Vodafone Business service revenue declined 4.3 percent due to the absence of one-off project revenue from the prior year.

In mobile, contract customers fell by 73,000, due to the disconnection of 53,000 low-value business SIMs. Three UK consumer losses continued, but churn improved significantly, falling 1.7 percentage points year on year. Prepaid brands VOXI and SMARTY added 38,000 customers.

Vodafone strengthened its position as the UK’s fastest-growing broadband provider, adding 64,000 broadband customers and expanding gigabit coverage to 22 million households. The company also added 11,000 fixed wireless access customers.

VodafoneThree became the UK’s largest mobile operator with more than 28 million customers across multiple brands. Integration progress has been rapid, with spectrum and network sharing ahead of schedule. Around 28.6 million customers now benefit from seamless access to both networks, more than 8,000 radio sites have been upgraded, 16,500 square kilometres of coverage gaps removed, and 7 million customers are seeing up to 40 percent faster 4G speeds.

Other Europe

Vodafone Other Europe delivered moderate growth in Q3 FY2026, with revenue rising 5.1 percent to €1.5 billion, mainly driven by the consolidation of Telekom Romania Mobile following the asset acquisition completed in October 2025.

Service revenue increased 3.5 percent, improving from a decline in the previous quarter. Growth in Albania, the Czech Republic, Ireland and Greece was partly offset by ongoing ARPU pressure in Portugal and strong competition in Romania. The quarter-on-quarter improvement was largely driven by stronger Vodafone Business revenue.

In Portugal, service revenue declined due to competitive pressure impacting mobile ARPU, although mobile contract and broadband customer bases continued to grow. Ireland recorded service revenue growth supported by customer gains and pricing actions across mobile and fixed services.

Vodafone Business service revenue increased 3.0 percent, with organic growth of 4.7 percent driven by project delivery in Greece and Romania and strong demand for digital services.

Across the region, Vodafone added 80,000 mobile contract customers and 4,000 broadband customers during the quarter, despite losing 70,000 mobile contract customers linked to the newly acquired Telekom Romania brand.

Turkiye

Vodafone Turkiye faced currency headwinds in Q3 FY2026, with total revenue declining 14.5 percent to €0.8 billion as strong service revenue growth was offset by the depreciation of the local currency.

Vodafone Business delivered particularly strong performance, with organic service revenue rising 54.8 percent driven by demand for digital services and core connectivity.

Customer growth remained positive, with 212,000 mobile contract additions during the quarter, including prepaid-to-contract migrations.

Vodafone Turkiye strengthened its future network position by acquiring 100 MHz of spectrum in the country’s 5G auction for US$627 million (€539 million). Payments will be spread over three years, and the company plans to launch 5G services in 2026. Existing spectrum licences were also renewed until 2042.

Africa

Vodafone Africa (Vodacom) delivered strong growth in Q3 FY2026, with total revenue rising 6.6 percent to €2.2 billion as higher service revenue was partly offset by currency depreciation.

Service revenue increased 8.2 percent, while organic service revenue grew 13.5 percent, driven by growth across all Vodacom markets.

In South Africa, service revenue growth was supported by strong Business performance, although mobile prepaid growth faced tough comparisons. Financial services accelerated, with organic growth of 8.4 percent driven by insurance demand.

Egypt maintained strong momentum, with service revenue growth well above inflation thanks to customer gains and strong data demand. Vodafone Cash continued to expand rapidly, with revenue rising 60 percent organically to €47 million and contributing nearly 10 percent of Egypt’s service revenue.

Vodacom’s international markets showed improving trends, particularly in Mozambique and the Democratic Republic of Congo. M-Pesa revenue increased 24.6 percent to €133 million, accounting for over 30 percent of service revenue, supported by strong data demand.

Vodacom Business service revenue grew 6.9 percent, with organic growth of 12.3 percent driven by mobile connectivity, digital services and IoT demand.

Customer growth remained strong across the region. South Africa added 471,000 mobile customers, with data usage reaching 73.6 percent of the base. Egypt added over 1 million mobile customers, while Vodafone Cash reached 13.5 million active users. Vodacom’s international markets added 2 million mobile customers, bringing the base to 65.7 million, while M-Pesa reached 28.4 million active users.

BABURAJAN KIZHAKEDATH