Telenor reported revenue of NOK 19,844 million in Q4 2025, up 2.9 percent from NOK 19,285 million a year earlier, driven mainly by stronger service revenues in the Nordic markets and higher national roaming income in Norway. Device sales remained stable year over year.

Service revenue reached NOK 15,311 million, increasing 0.5 percent year over year and 2.6 percent organically. Growth was supported by solid mobile performance in the Nordics, with organic mobile service revenue rising 4.0 percent due to higher ARPU, particularly in Norway and Finland. Fibre growth helped fixed services, though churn on legacy products in Sweden and Denmark offset some gains. Contributions from Grameenphone and Telenor Connexion also supported growth.

“We are entering 2026 with a simplified portfolio and strengthened financial capacity,” CEO Benedicte Schilbred Fasmer said in the earnings report.

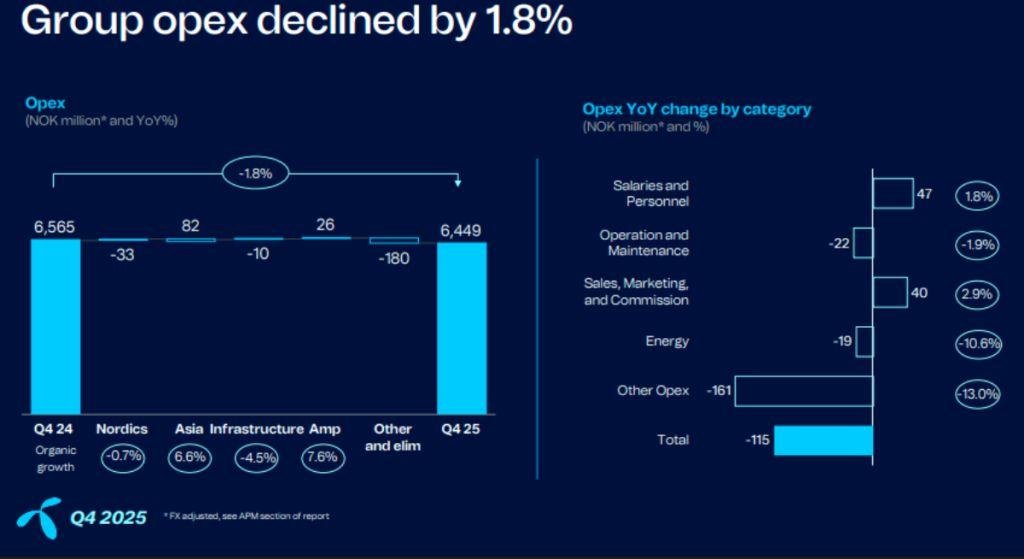

Operating expenses fell to NOK 6,426 million, down 3.4 percent year over year, reflecting transformation initiatives in the Nordics, including expanded shared services and improvements in Sweden’s customer service operating model. These savings were partly offset by higher costs in Asia and Amp.

Capex excluding leases declined 18.1 percent to NOK 3,074 million as 5G rollout reached a more mature stage. Investments focused on mobile network modernisation, fibre expansion, and IT transformation in the Nordics. The capex-to-sales ratio fell to 15.5 percent, reflecting lower capital intensity. For full-year 2025, capex excluding leases totaled NOK 10,535 million, with a capex-to-sales ratio of 13.8 percent, down from 2024.

Telenor Norway

Telenor Norway reported revenue of NOK 5,307 million (up 2.9 percent) in Q4-2025 and NOK 20,996 million (up 2.5 percent) in 2025.

Telenor Norway delivered solid financial performance supported by its value-focused commercial strategy and disciplined cost control. Intensifying competition during the peak sales season led to a decline of 17,000 mobile subscriptions, but a 5 percent ARPU increase driven by the “more-for-more” strategy offset the drop in subscribers and lifted mobile service revenues by 2.9 percent.

In fixed services, growth in fibre revenues compensated for declines in legacy products. Fixed service revenues rose 2.8 percent, including a positive impact from a VAT-related adjustment last year. Fibre subscriptions increased by 12,000, offsetting reductions in cable and fixed wireless access customers.

Operating expenses rose 3.4 percent due to the transfer of sites from Towers Norway, storm Amy-related maintenance, and higher project activity, although lower personnel costs helped partly mitigate the increase.

Telenor Sweden

Telenor Sweden reported revenue of NOK 2,726 million (up 10.9 percent) in Q4-2025 and NOK 10,667 million (up 6.9 percent) in 2025.

Strong demand during the peak sales season drove a net increase of 45,000 mobile subscriptions, lifting the mobile subscriber base 3 percent year over year. Together with a 2 percent rise in ARPU, this supported 4.6 percent organic growth in mobile service revenues.

In the fixed segment, the ongoing transformation and phase-out of less profitable products led to a decline of 17,000 fibre subscriptions and a 5.0 percent organic drop in fixed service revenues.

Operating expenses fell 5.8 percent organically, supported by customer service transformation, lower network operating costs and a VAT adjustment effect from last year. These savings, along with improved gross profit from the fixed transformation, drove organic adjusted EBITDA growth of 11.0 percent, or 7.6 percent excluding the VAT impact.

Telenor Sweden also achieved a key milestone by decommissioning its 2G and 3G networks, with its 4G and 5G network now covering 99.9 percent of the population.

Telenor Denmark

Telenor Denmark reported revenue of NOK 1,190 million (up 6.9 percent) in Q4-2025 and NOK 4,730 million (up 6.7 percent) in 2025.

Strong seasonal sales drove a net addition of 8,000 mobile subscriptions in the fourth quarter, with particularly strong growth in fixed wireless access. Fibre broadband subscriptions increased by 11,000, while copper services were fully shut down in November after customers were migrated to newer technologies.

Mobile ARPU rose 2 percent due to pricing actions, value-added services and portfolio mix improvements. Together with subscriber growth, this led to 5.8 percent organic growth in mobile service revenues. Fixed service revenues declined 9.0 percent organically, as fibre growth and price increases were outweighed by falling revenues from legacy xDSL broadband. Overall, total service revenues increased 3.6 percent organically.

Operating expenses rose 2.7 percent organically, as savings in personnel costs were more than offset by transformation initiatives and higher sales and marketing investments to support growth.

DNA

Telenor’s DNA reported revenue of NOK 2,627 million (up 3.9 percent) in Q4-2025 and NOK 10,316 million (up 5.5 percent) in 2025.

Intensified competition in Finland during the peak sales season led to higher churn and a decline of 7,000 postpaid subscriptions, mainly in mobile broadband. Seasonal reductions and a prepaid clean-up resulted in total subscriptions falling by 32,000 in the quarter.

Despite this pressure, mobile service revenues grew 4.3 percent organically, supported by upselling, pricing initiatives and a larger mobile subscriber base. Total organic service revenues increased 3.9 percent year over year, with fixed service revenues rising 2.4 percent, driven mainly by fibre growth that added 5,000 new subscriptions and offset declines in legacy and TV services.

Operating expenses decreased 5.8 percent organically, primarily due to lower operation and maintenance costs and reduced bad debt provisions.

Grameenphone

Grameenphone reported revenue of NOK 3,031 million (down 16.3 percent) in Q4-2025 and NOK 12,830 million (down 11 percent) in 2025.

Grameenphone’s performance remained affected by a subdued macroeconomic environment in Bangladesh, marked by cautious consumer behaviour and weak government and business spending. Service revenues grew 3.4 percent, but underlying growth was flat after adjusting for a prior-year revenue correction, indicating a slow and uncertain recovery.

During the quarter, regulatory changes limiting the number of SIM cards per person led to the de-registration of 1.1 million subscribers, leaving the total base at 83.9 million, with only a minor revenue impact. Operating expenses rose 2.1 percent due to higher operation and maintenance costs, but cost optimisation efforts helped support adjusted EBITDA growth of 4.8 percent.

In January 2026, Grameenphone secured 2×10 MHz of spectrum in the 700 MHz band at a Bangladesh Telecommunication Regulatory Commission auction. The 13-year licence, valued at about BDT 22 billion (around NOK 1.8 billion), will be paid in 10 annual instalments and is expected to improve indoor coverage and rural connectivity.

CelcomDigi

CelcomDigi reported 1.5 percent growth in service revenues for the quarter, driven by gains in consumer postpaid, wholesale and fibre segments, which were partly offset by declines in consumer prepaid and enterprise mobile. Higher cost of goods sold and increased provisions for doubtful debts weighed on profitability, leading to an 11.2 percent drop in EBITDA and a 16.0 percent decline in EBIT due to higher depreciation and amortisation.

Network integration and modernisation surpassed 90 percent completion, improving service quality and supporting rising connectivity demand. The company maintained its 2025 outlook for low single-digit service revenue growth and low-to-mid single-digit EBIT growth. CelcomDigi also declared a third interim dividend of MYR 0.036 per share, with Telenor receiving NOK 346 million in December.

Looking ahead, associate Digital Nasional Berhad is expected to secure an additional 100 MHz of C-Band spectrum ahead of the Malaysian government’s planned exit from DNB in the second quarter of 2026.

BABURAJAN KIZHAKEDATH