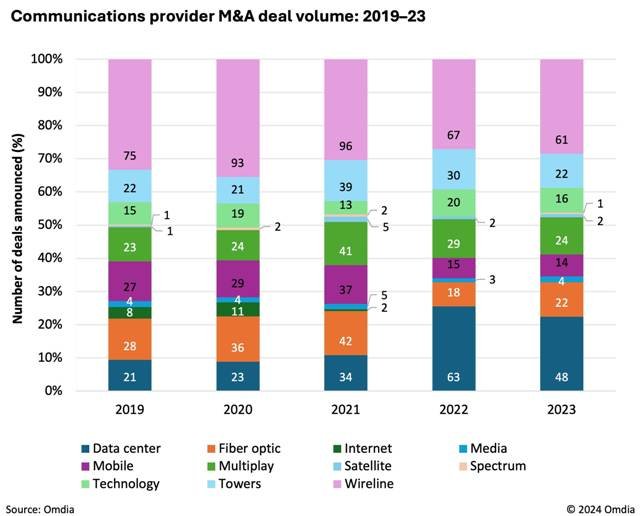

Communications service providers (CSPs) have experienced significant consolidation in recent years, with 514 mobile and wireline mergers and acquisitions (M&A) deals worldwide between 2019 and 2023, according to Omdia’s latest research.

M&A Deal Volume from 2019-2023

During this period, wireline M&A deals outpaced mobile deals, with 392 wireline and 122 mobile M&A transactions. Notable mobile M&A activity includes the planned merger of Vodafone and Three in the UK, a deal that, if approved by the Competition and Markets Authority, will establish the UK’s second-largest mobile operator by subscriptions.

Recent Trends and Market Dynamics

In 2023, the number of M&A deals across all communications provider sectors totaled 214, down from a peak of 316 in 2021. This decline reflects challenges such as high interest rates and a cyclical downturn in the technology industry.

Despite this downturn, the telecom market’s dynamics suggest a continued strong drive for further M&A among CSPs.

Matthew Reed, Chief Analyst for Service Providers & Markets at Omdia, explained, “With revenues in the telecom sector growing at a low rate while markets are competitive and increasingly mature, many more CSPs will seek consolidation to cut costs by eliminating duplication and invest in network technologies such as fiber and 5G to propel growth in their connectivity business.”

Strategic Benefits of M&A

Merging allows operators to benefit from economies of scale, increased competitiveness against other major players, opportunities for cross-selling, and enhanced clout in procurement. Beyond consolidation, telecom operators are engaging in M&A to implement delayering and diversification strategies.

Delayering and Diversification Strategies

Delayering involves CSPs selling infrastructure assets, such as telecom towers, to raise funds for debt reduction or investment in other business areas. For instance, in July, Telecom Italia (TIM) completed the sale of its fixed-line business in Italy to investment group KKR. This sale enables TIM to focus on growth through new beyond-connectivity consumer services and enterprise ICT services.

CSPs are also acquiring companies in high-growth technology sectors to diversify their offerings. Both Orange and Telefonica have expanded significantly into the cybersecurity sector through strategic acquisitions.

“For telecom operators that want to become technology services providers, one way to make that transition is to buy companies that already have the capabilities and customer base in the target sectors,” Matthew Reed said.