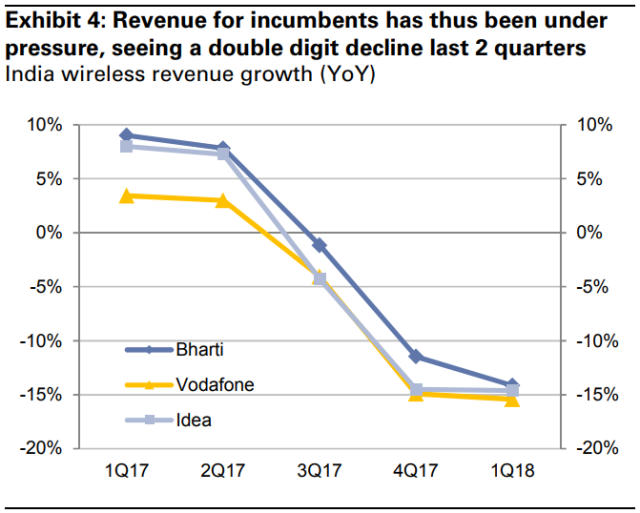

Airtel, Reliance Jio and Idea Cellular are framing their content strategy to improve revenue growth at a time when voice business is under pressure.

Airtel, Reliance Jio and Idea Cellular are framing their content strategy to improve revenue growth at a time when voice business is under pressure.

Goldman Sachs says content will not be offering any special benefit to Indian telecom operators.

“We do not think content will lead to a competitive advantage for one telecom operator vs the other,” said Manish Adukia and Piyush Mubayi of Goldman Sachs.

In terms of the content market, Indian telecom space is totally different from the US market. US telecoms are in the process of buying digital media companies to enhance their content offerings. Acquisition of AOL, Yahoo, Time Warner is the best examples for US telecoms’ content strategy.

Reliance Industries (RIL) — that owns 4G operator Reliance Jio — announced the acquisition of 24.9 percent stake in Balaji Telefilms in July 2017.

Jio may look to bid for digital rights of Indian Premier League – a popular cricket tournament in India, according to media reports.

Reliance Jio has a number of apps as part of its wireless offering, which includes music, movies, live television, newspapers and magazines, among other things.

The below chart indicates about the revenue decline of top three telecom operators such as Airtel, Vodafone and Idea Cellular.

Reliance Industries already owns a majority stake in TV18, which is one of the top 5 broadcasters in the country.

Reliance Industries already owns a majority stake in TV18, which is one of the top 5 broadcasters in the country.

Reasons

Content in India is available in abundance. Similar to other markets across the world, video is the key driver of data demand, with more than two-thirds of data consumption towards video. A lot of content in India is available for free.

All major broadcasters in the country – Star, Colors, Sony and Zee – have apps that offer access to a large chunk of their content for free. Indian consumers get unrestricted access to YouTube, which has a vast library of content.

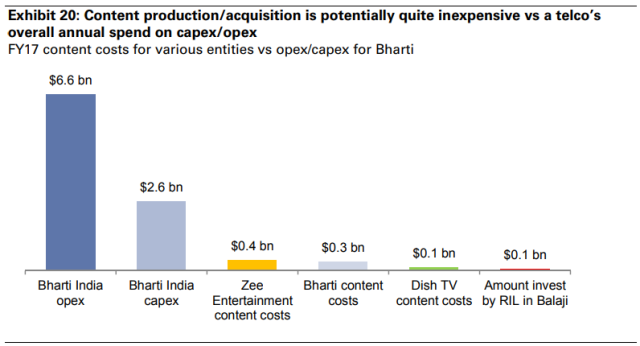

Content in India is inexpensive. Zee Entertainment, is one of India’s top 3 television broadcasters, spent $400 million in FY17 to commission content. This $400 million equals ~6 percent of Bharti India’s total Opex in FY17. Zee’s $400 million spend helped it produce more than 25,000 hours of content, which is 25x of Netflix’s original programming hours target for 2017.

The amount invested by RIL in Balaji is less than 3 percent of Airtel’s India Capex (capital expenditure) in fiscal 2017.

Similar to Jio, Bharti has apps that offer music, movies, live TV etc. Idea Cellular too announced launch of its own suite of apps earlier this year.

“Broadcasters in India are not allowed by regulation to discriminate between distributors, and thus telecom operators are unlikely to have access to exclusive content unless they produce or acquire it themselves,” Manish Adukia and Piyush Mubayi of Goldman Sachs said.

Goldman Sachs said content bundling could help drive up ARPUs for telecoms. But one particular telecom operator will be able to do this significantly better than the others.