Indian telecom companies are set to see a substantial increase in average revenue per user (ARPU) per month, anticipated to rise by approximately 25 percent in fiscal 2026 compared to fiscal 2024, CRISIL Ratings said.

The latest TRAI report said monthly ARPU for wireless service in India increased by 0.64 percent, from Rs 152.55 in QE Dec-2023 to Rs 153.54 in QE Mar-2024.

Prepaid ARPU of Indian telecom operators increased from Rs 149.56 in QE Dec-2023 to Rs 150.74 in QE Mar-24.

Postpaid ARPU of Indian telecom operators decreased from Rs 189.08 in QE Dec-2023 to Rs 187.85 in QE Mar-2024, TRAI said.

Three telecom operators — Vodafone Idea, Reliance Jio and Bharti Airtel — have hiked their cellular charges early this month.

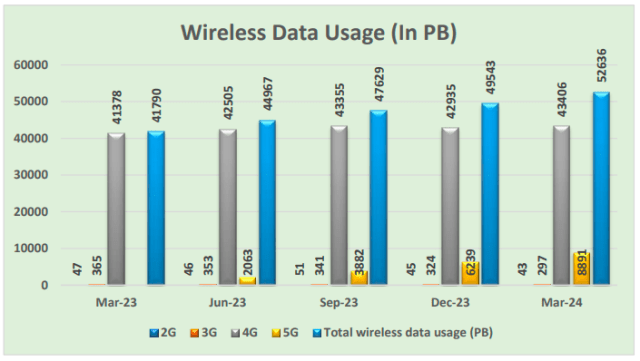

The latest information from TRAI indicates that wireless data usage in India increased from 49,543 PB during Q.E. Dec-2023 to 52,636 PB during Q.E. Mar-2024 with quarterly rate of growth 6.24 percent.

Out of data wireless usage, 2G data usage was 43 PB, 3G data usage was 297 PB, 4G data usage was 43,406 PB and 5G data usage was 8,891 PB during the January-March quarter of 2024.

TRAI said number of data subscribers increased from 896.68 million at the end of Dec-2023 to 913.34 million at the end of Mar-2024. The contribution of 2G, 3G, 4G and 5G data usage in total volume of wireless data usage are about 0.08 percent, 0.56 percent, 82.46 percent and 16.89 percent respectively during the QE Mar-2024.

This growth is driven by a tariff hike and increased data consumption. Additionally, a moderation in capital expenditure (capex) due to reduced network investments post-5G rollout and limited spectrum renewals will enhance return on capital employed (RoCE) and support industry deleveraging, thereby improving credit profiles, says Manish Gupta, Senior Director and Deputy Chief Ratings Officer at CRISIL Ratings.

The ARPU is expected to reach a decadal high of Rs 225-230 by the end of the next fiscal year, up from Rs 182 in the previous fiscal year. This growth is propelled by recent tariff increases of 17-19 percent by telcos and organic data usage growth amid rising 5G adoption. Customers are upgrading their plans due to increased content consumption via video streaming, social media, and online gaming, resulting in higher ARPUs.

ARPU increase will be gradual over this fiscal year and the next as tariff hikes take effect in subsequent recharge cycles for long-duration plans. This will boost operating profitability, lifting industry RoCE to approximately 11 percent next fiscal from around 7.5 percent in fiscal 2024. The industry has experienced a prolonged period of suppressed RoCEs due to substantial investments in new technology rollouts and spectrum liabilities.

Capex intensity, which averaged about 28 percent over the past three fiscal years, is expected to decrease to roughly 19 percent by the next fiscal year as most players have completed their 5G rollouts. While ongoing network Capex for fiberisation of telecom towers, establishment of base transceiver stations, and small cell network augmentation will continue, it will proceed at a slower pace.

Similarly, new spectrum Capex is likely to reduce since most spectrum purchases were completed in fiscal 2023, with the next significant renewal due in 2030. This trend was evident in the recent June 2024 auction, which saw bids totaling Rs 11,341 crore, or about 12 percent of the total airwaves on offer, with nearly half of the amount spent on spectrum renewals.

The moderation in Capex coupled with healthy profitability will enable telcos to reduce their debt to approximately Rs 5.6 lakh crore next fiscal from a peak of around Rs 6.4 lakh crore in fiscal 2024. About half of the debt on balance sheets pertains to spectrum purchases, which have a long repayment schedule.

“Debt reduction will improve the industry’s debt-to-Ebitda ratio to less than 3 times next fiscal from approximately 4.3 in fiscal 2024, enhancing credit risk profiles,” Anand Kulkarni, Director at CRISIL Ratings, stated.

CRISIL Ratings’ estimates do not account for any further tariff hikes by telcos, which could provide additional upside. Moving forward, the industry’s ability to maintain a competitive landscape and manage higher-than-expected network capex will be key factors to monitor.

Baburajan Kizhakedath