India’s telecom sector continued its strong growth trajectory in December 2025, with total wireless subscribers reaching 1,258.77 million and broadband subscriptions crossing the 1 billion milestone, according to the latest Telecom Regulatory Authority of India (TRAI) data.

The report highlights steady expansion in mobile connectivity, rising broadband adoption, and intensifying competition among private telecom operators.

Wireless subscriber base grows with 8.21 million additions

India’s total wireless subscriber base, including mobile and Fixed Wireless Access (FWA), rose to 1,258.77 million in December 2025, up from 1,250.56 million in November. The monthly growth rate stood at 0.66 percent, driven by 8.21 million net additions during the month.

Active wireless subscribers, measured by peak Visitor Location Register (VLR), reached 1,162.97 million, indicating that about 92.4 percent of the total subscriber base remains active.

Wireless tele-density in the country stood at 88.41 percent.

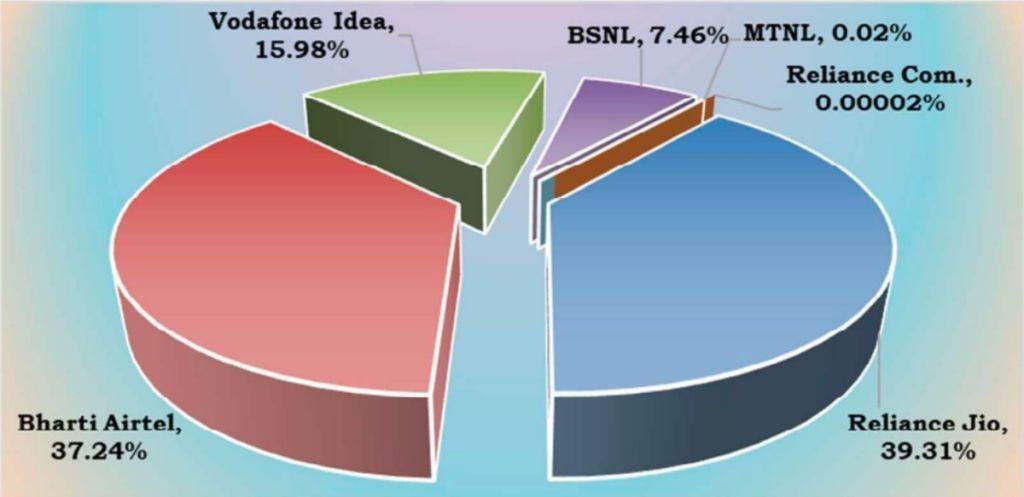

Private telecom operators continue to dominate the wireless market with a 92.53 percent share.

Operator performance in wireless segment

Bharti Airtel recorded the highest subscriber growth in December with net additions of 5.43 million users, largely due to the inclusion of its Machine-to-Machine cellular subscriber base in reporting. Airtel’s wireless market share reached 37.24 percent.

Reliance Jio added 2.96 million subscribers and maintained leadership with a 39.31 percent market share.

Vodafone Idea continued to lose subscribers, reporting a decline of 0.94 million and holding a 15.98 percent market share. Among public sector operators, BSNL lost 0.21 million subscribers with a 7.46 percent share, while MTNL recorded a marginal decline and maintained a negligible 0.02 percent market share.

Broadband subscribers cross 1 billion milestone

India’s total broadband subscriber base reached 1,007.35 million by the end of December 2025, marking a significant milestone in the country’s digital connectivity journey.

Broadband segment breakdown

Mobile wireless broadband (3G, 4G, 5G): 947.30 million subscribers

Fixed wired broadband (DSL, FTTx): 45.29 million subscribers

Fixed Wireless Access: 14.77 million subscribers

Reliance Jio led the broadband market with 514.35 million subscribers, followed by Bharti Airtel with 314.26 million. Vodafone Idea, BSNL, and ACT Fibernet rounded out the top five providers, which together accounted for 98.52 percent of the broadband market.

Wireline segment sees steady growth led by private players

India’s wireline subscriber base increased to 47.37 million, with a net addition of 0.32 million subscribers in December. Wireline tele-density reached 3.33 percent.

Private telecom providers held 80.30 percent of the wireline market, while public sector operators BSNL, MTNL, and APSFL accounted for 19.70 percent.

Reliance Jio led wireline growth with 205,033 net additions and a 31.14 percent market share. Bharti Airtel followed with 189,628 additions and a 23.13 percent share. Tata Teleservices added 3,362 subscribers and held a 23.29 percent share.

BSNL, MTNL, and Vodafone Idea recorded losses in the wireline segment during the month.

M2M inclusion boosts tele-density metrics

Beginning December 2025, Bharti Airtel started including its Machine-to-Machine cellular connections in wireless reporting, significantly impacting overall metrics.

India’s overall tele-density reached 91.74 percent including M2M connections. Excluding M2M, tele-density stood at 84.01 percent.

Rural vs urban telecom growth gap continues

The total number of telephone subscribers in rural India reached 543.70 million, including 538.62 million wireless and 5.08 million wireline users.

Urban subscribers totaled 762.44 million, including 720.15 million wireless and 42.29 million wireline connections.

Wireless subscriptions grew 0.96 percent in urban areas compared to 0.25 percent in rural regions.

Rural tele-density reached 59.63 percent, while urban tele-density remained significantly higher at 148.92 percent, highlighting the continuing digital divide.

5G FWA growth and high portability demand

5G Fixed Wireless Access continued to gain momentum, with subscribers rising to 10.99 million and adoption nearly evenly split between rural and urban areas.

Mobile number portability remained strong, with 16.12 million subscribers submitting requests to switch operators during December 2025, according to TRAI.