Fitch Ratings has revealed its views on India’s telecom sector indicating that there will be improvement in the coming year.

Bharti Airtel and Reliance Jio Infocomm are forecasted to achieve around 10 percent EBITDA growth in 2025.

There will be a projected 8 percent increase in ARPU (Average Revenue Per User) driven by higher data consumption.

There will be rising monthly data usage, which as of June 2024, stood at 21.3 GB per user — one of the highest in the Asia-Pacific region.

Higher ARPU is expected to support a widening of EBITDA margins.

Reduced capital expenditure will boost FCF for leading players such as Bharti Airtel and Reliance Jio.

Significant 5G-related investments have already been made, and capex as a percentage of revenue is expected to decline.

Offset factors include higher spectrum repayments and continued investment in fiber infrastructure.

Vodafone Idea’s capacity to compete and invest hinges on its ability to raise additional funds, which remains uncertain.

Faster adoption of 5G or accelerated fiber-to-the-home rollouts could lead to unexpectedly high capex, delaying FCF growth.

Despite no differentiated pricing between 5G and 4G plans, telcos aim to increase data consumption by encouraging upgrades.

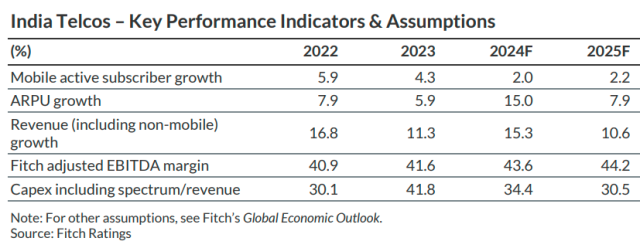

The above chart indicates predictions on growth in mobile subscribers, ARPU, revenue and Capex intensity for 2024 and 2025.

Lower-than-expected data usage growth could reduce ARPU improvement and cash generation.

No immediate tariff hikes are anticipated following the July 2024 increase. ARPU growth will likely depend on two factors: First, shifting users to postpaid plans and second, upgrades to higher-priced data plans. Risks in Indian telecom market include potential price wars or government interventions in tariff regulation.

Improved financial flexibility may lead Reliance Jio and Bharti Airtel to pursue acquisition opportunities in adjacent sectors such as digital TV, data centers, and technology. If M&A is substantial and funded through debt, it could negatively affect credit metrics, Fitch Ratings said.

India’s telecom sector remains poised for growth with increasing data consumption and profitability focus among key players. However, risks associated with capital expenditure, ARPU growth, and potential M&A activities warrant close monitoring.