TowerXchange, an independent community for telecom tower industry, has recently released the latest statistics for telecom towers in India.

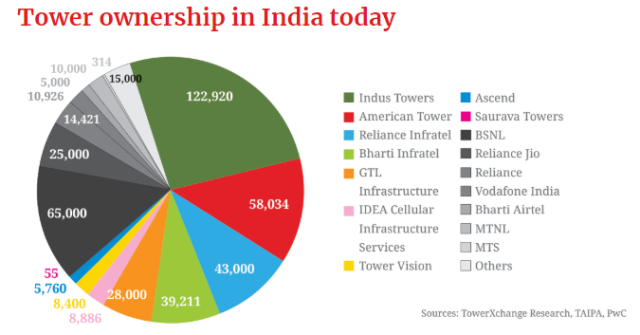

The above chart shows the market share of Indian telecom tower companies. Indus Towers is the leader in the Indian telecom tower market with 122,920 towers in its portfolio.

American Tower is the second largest telecom tower company with 58,034 towers.

Reliance Infratel is the third largest telecom tower company with 43,000 towers in its business. Bharti Infratel has 39,211 telecom towers. GTL Infrastructure has 28,000 telecom towers in India.

Latest telecom tower deals

Vodafone India and Idea Cellular have completed their merger becoming the largest telecom operator – in terms of mobile subscribers — in India.

Vodafone and Idea Cellular have both divested their tower portfolios to American Tower. American Tower will add a combined 20,000 sites.

6,300 co-located tenancies will become single ones for American Tower, without exit penalties, due to the merger.

Reliance Communications (RCom) will divest its 43,000 towers, fibre and spectrum rights to Reliance Jio.

Bharti Infratel and Indus Towers received the approval of the Competition Commission of India for their merger. The combined entity will run over 163,000 towers across India and will be controlled by Airtel and Vodafone.

BSNL has received the approval for the divestment of 66,000 telecom towers into a separate infrastructure unit. BSNL’s divestment of towers could be valued up to $3 billion.

MTNL is considering divesting its 10,000 towers to reduce its debts.

Indian telecom operators’ 3G coverage is expected to reach around 95 percent in the next 18-24 months. Mobile operators’ 4G rollout has already started in tier one and tier two cities. 4G rollout is expected to have a marginal impact on the profitability of Indian tower cos.

Telecom tower companies are adding the majority of BTS through ‘loading’ – the addition of a second set of antenna by an existing tenant. But Indian 4G operators will soon add infill cell sites for densification – impacting a significant increase in tower cash flow.

Baburajan K