The mobile core network (MCN) market 5-year cumulative revenue forecast is expected to decline 10 percent during 2024-2028, according to Dell’Oro Group.

Analysts at Dell’Oro Group did not reveal the size of mobile core network market.

The significant decrease in the mobile core network revenue will be due to severe economic headwinds, primarily the high inflation rates, and the slow adoption of 5G Standalone (5G SA) networks by mobile network operators (MNOs).

The number of 5G SA networks deployed by MNOs reached 50 5G SA networks indicating that it remains the same as it was at the end of 2023.

“The build-out of 5G SA networks will wane compared to 5G Non-standalone networks,” said Dave Bolan, Research Director at Dell’Oro Group. “This is the first 5-year forecast out of the last five where the 5-year CAGR (2023-2028) has fallen into negative territory.”

Dell’Oro Group has reduced the 5-year revenue forecast for the Multi-Access Edge Computing (MEC) market, a sub-segment of the MCN market, by 18 percent.

In the case of MEC, the adoption rate is slowed much more than the overall MCN market. The industry is addressing these concerns with several initiatives such as open gateway application programmable interfaces (APIs) to attract the application development community to develop applications for the mobile industry.

Release 18 is introducing capabilities for new use cases, and Reduced Capability (RedCap) RAN software to bring more 5G IoT devices to market. These initiatives will take time to bring solutions to market and more importantly at scale to have an impact on the overall market growth.

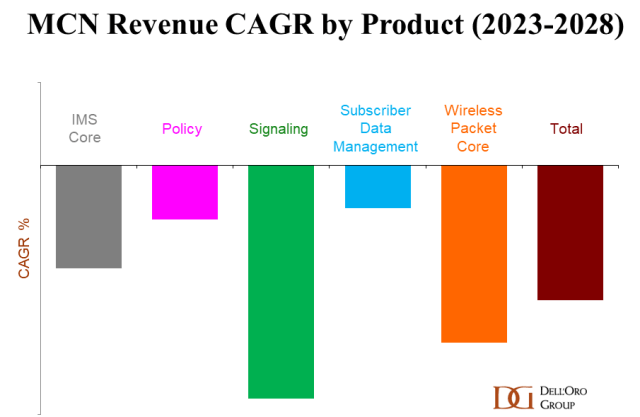

The CAGR is negative for all product segments — Packet Core, Policy, Signaling, Subscriber Data Management, and IMS Core.

The CAGR for the market segments is positive for 5G MCN and MEC, and negative for 4G MCN and IMS Core.

The CAGR by regions is positive for Asia Pacific excl. China, Europe, Middle East and Africa (EMEA), and Worldwide excluding China. The regions with negative CAGRs are North America, CALA, China, and Worldwide excluding North America, Dell’Oro Group said.