The telecom service provider outsourcing market revenue rose 1 percent to $67 billion in 2017, said a report by IHS Markit.

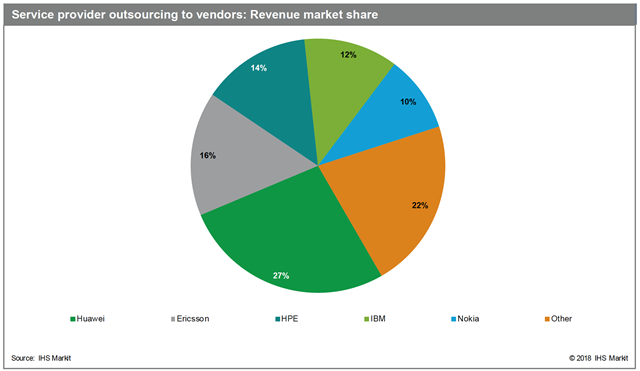

Huawei has maintained its professional services market lead, with 27 percent of revenue, a gain of 3.5 percentage points.

Huawei has maintained its professional services market lead, with 27 percent of revenue, a gain of 3.5 percentage points.

Huawei has achieved double-digit growth in the telecom operator outsourcing market. Other big technology vendors faced declines.

Ericsson and Nokia exited unprofitable outsourcing contracts. Huawei picked up most of the outsourcing deals exited by Ericsson and Nokia.

Ericsson is in the second place with 16 percent share in the global telecom service provider outsourcing market.

Ericsson last week said it has identified 42 managed services contracts out of nearly 300 for exit, renegotiation or transformation.

Ericsson addressed 40 of the 42 contracts, resulting in an annualized profit improvement of approximately SEK 0.9 billion. Ericsson aims to improve the operating margin of managed services business to 4-6 percent in 2020.

HPE has 14 percent share of the telecom service provider outsourcing market.

IBM has 12 percent share in the worldwide telecom service provider outsourcing market.

Nokia has 10 percent share in the global telecom service provider outsourcing market in 2017.

“Without Huawei running on every front of the professional services business and picking up some of the contracts Ericsson exited, the global market would have tanked,” said Stephane Teral, executive director – Research and Analysis, Mobile Infrastructure & Carrier Economics.

US-based Sprint, a subsidiary of SoftBank of Japan, took back its network operations from Ericsson, setting the stage for a deal with T-Mobile US, which reduced the market in the North America region.

The telecom operator outsourcing market is expected to reach $68 billion by the end of 2018, achieving 2 percent revenue growth over the previous year. The market could hit $72 billion by 2022, growing at a compound annual growth rate (CAGR) of 1.4 percent, said IHS Markit.