The latest Reuters report has revealed how US-based technology companies will be negatively impacted by the recent U.S. decisions on Huawei Technologies.

The U.S. decision to blacklist Huawei, which needs prior approval from the Donald Trump administration to source technology components from local companies, will impact the global tech supply chain, linked closely to the $105 billion business of the world’s top supplier of telecoms network equipment.

Huawei said it is against the decision made by the Bureau of Industry and Security (BIS) of the US Department of Commerce.

This decision will do significant economic harm to the American companies with which Huawei does business, affect tens of thousands of American jobs, and disrupt the current collaboration and mutual trust that exist on the global supply chain.

Marvell Technology, Keysight Technology, Nvidia, Maxim Integrated, Finistar, Texas Instruments, CommScope, Microsoft, Lumentum, Western Digital, NeoPhotonics, Advance Micro Device, Analog Devices, Corning, Skyworks, Intel, Qorvo, Micron Technology, Seagate Technology, Qualcomm, Broadcom, Flex, among others, are some of the key suppliers to Huawei.

The Trump administration has said it would add Huawei Technologies and 70 affiliates to its “Entity List” – a move that will likely ban the firm from acquiring U.S. components and technology without government approval, adding another incendiary element to the U.S.-China trade war.

A similar U.S. ban on China’s ZTE had almost crippled business for the smaller Huawei rival early last year before the curb was lifted.

Huawei spent $70 billion on component procurement from global technology companies in 2018. Huawei’s spending on component from U.S. technology firms including Qualcomm, Intel and Micron Technology was $11 billion.

On the other hand, U.S. companies like Apple, Cisco, HPE, IBM, Oracle, Microsoft, Google, among others, face the risk of severe retaliation from China, a key market.

Huawei will not be able to replace its U.S. suppliers within a few years.

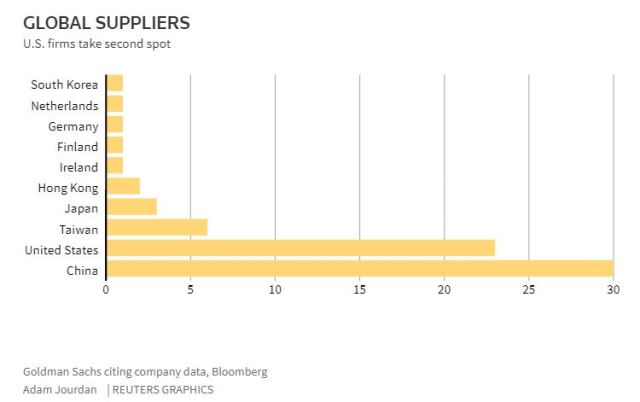

United States is the second largest component supplier, while Taiwan, Japan, Hong Kong, Ireland, Finland, Germany, Netherlands and South Korea are the top technology suppliers to Huawei.

Revenue for the company, also the world’s second-biggest maker of smartphones, touched $105 billion last year, eight times ZTE’s and half the annual sales of South Korea’s Samsung Electronics.

A range of Asian and European suppliers would also be hurt if Huawei was forced to curb production, while telecom carriers that rely on Huawei, and have largely resisted U.S. calls to bar the company, would be left scrambling just as countries race to roll out next-generation 5G mobile networks.

Huawei can relatively better manage component sourcing for smartphones because they have their own component businesses for smartphones. Huawei’s business in network and servers will be hit.

Brokerage Jefferies said the sanctions would mean a nightmare for China’s 5G. The country, which is targeting a nationwide rollout next year, will very likely slow down its 5G push as a result.

In addition to the blacklisting of Huawei Technologies, the United States has also decided against sourcing telecom equipment from Huawei for local use.

Baburajan K