Taiwan Semiconductor Manufacturing (TSMC) announced significant cut in investment in 2019 due to a slowdown in smartphone demand.

TSMC said the reduction in its investment will be in several hundred million dollars. TSMC did not share further details.

TSMC said the reduction in its investment will be in several hundred million dollars. TSMC did not share further details.

“Due to the macro economic outlook in 2019, we are tightening this year’s capital spending by several hundred million dollars to a level of between $10 billion to $11 billion,” TSMC Chief Financial Officer Lora Ho said.

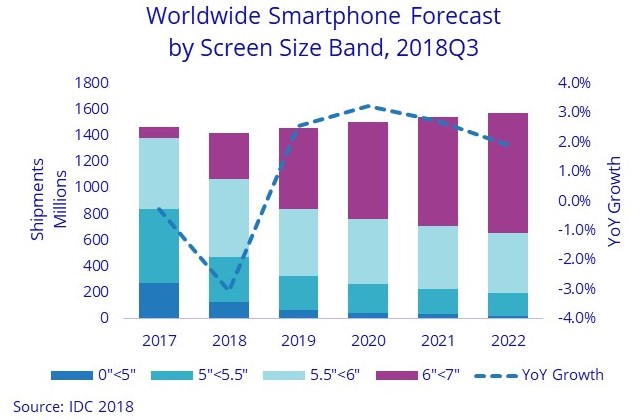

The latest IDC report said smartphone shipments will drop 3 percent to 1.42 billion units in 2018 from 1.47 billion in 2017. Smartphone shipment will grow at 2.6 percent in 2019. The global smartphone shipments are forecast to reach 1.57 billion units in 2022.

TSMC sales to hit

TSMC forecasts that its first-quarter revenue will be $7.3 billion to $7.4 billion due to tough market conditions. The nearly 14 percent drop would be the steepest decline since the March 2009 quarter, according to Refinitiv data, when revenue tumbled 54 percent in Taiwan dollar terms.

TSMC expects revenue growth to more than halve to 1-3 percent for the whole of 2019 from last year’s 6.5 percent.

TSMC revenue rose 2 percent to $9.40 billion in the December quarter of 2018. TSMC has posted 0.7 percent rise in fourth-quarter net profit to T$99.98 billion or $3.24 billion.

Phone challenges

Apple, the third largest smartphone maker, earlier this month cut its quarterly sales forecast due to weakening iPhone demand in China.

Samsung, the largest smartphone vendor from Korea, is also indicating that its smartphone business will be under pressure.

Huawei said it is expecting its total revenue to grow in 2019 after touching $100 billion plus in 2018.

Market research firm Canalys estimates that smartphone shipments fell 12 percent last year in China, the world’s biggest smartphone market, and expects shipments there to shrink another 3 percent this year to below 400 million for the first time since 2014.

TSMC, the world’s largest contract chipmaker, said a drop in sales of high-end smartphones has caused an inventory build-up, and weak demand will continue to weigh on it until new smartphone launches in the second half.

“The inventory in the supply chain is quite a lot, which may lead to a drop in the first half of 2019 for the smartphone business,” TSMC Chairman Mark Liu said at a post-earnings conference.