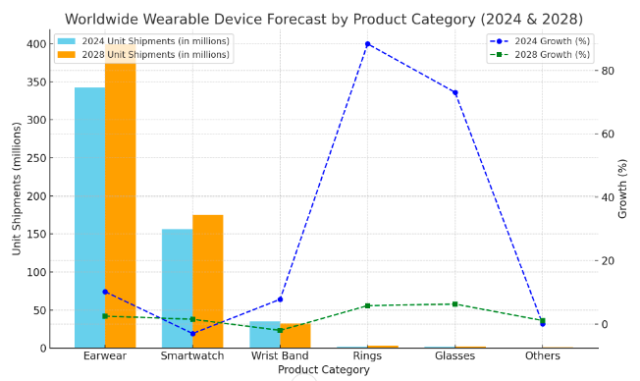

According to a recent forecast by IDC, global wearable device shipments are expected to increase by 6.1 percent in 2024, reaching 537.9 million units. By 2028, this number is projected to rise to 612.5 million, with earwear and smartwatches leading the market, IDC report said.

Earwear: Shipments are forecast to grow from 342.2 million units in 2024 to 399.0 million by 2028, driven by increased adoption in emerging markets and the start of a refresh cycle in mature regions. Despite a drop in average selling prices (ASPs) due to rising competition in the truly wireless segment, earwear remains a dominant force, representing over 60 percent of the wearables market.

Smartwatches: After an anticipated 3 percent decline in 2024, smartwatches are expected to recover in 2025 with a growth of 4.8 percent. While India’s market is expected to face consolidation due to a surge in low-cost white-label products, the global smartwatch market (excluding India) is set for a robust 9.9 percent growth. ASPs are predicted to rise by 5.7 percent as vendors focus on premium features and AI-driven health solutions. The size of the global smartwatch market will grow from 156.5 million in 2024 to 175.2 million in 2028.

Rings and Glasses: These emerging categories are also on the rise. The market for wearable rings will see substantial growth, nearly doubling from 1.7 million units in 2024 to 3.1 million in 2028. Smart glasses will follow suit, with shipments increasing from 1.8 million to 2.3 million units in the same period.

The size of the Earwear market will grow from 342.2 million in 2024 to 399.0 million in 2028. The size of the Wrist Band market will grow from 35.2 million in 2024 to 32.1 million in 2028.

Challenges facing the wearable device market

Price Pressure in Hearables: Hearables, which dominate over 60 percent of the wearable market, are facing declining average selling prices (ASPs), particularly within the truly wireless earwear segment. This drop is attributed to increased competition and growing demand for more affordable options, putting pressure on vendors to balance pricing with profitability.

Smartwatch Market Decline: For the first time, smartwatches are projected to see a year-over-year decline in shipments (-3 percent) in 2024, primarily driven by the influx of low-cost, white-label products in India. This has disrupted the market, causing over-saturation and leading to potential consolidation in the near term.

Rising Smartwatch Prices: Vendors face a significant challenge in justifying the rise in smartwatch ASPs, expected to increase by 5.7 percent in 2024. Consumers may resist paying higher prices for incremental improvements such as larger screens or new materials. Vendors will need to add innovative health features and advanced sensors to differentiate their products, but they must also effectively communicate the benefits of these additions to consumers.

Competition from Low-Cost Alternatives: Both the hearables and smart glasses markets are experiencing a surge in low-cost alternatives, with fast-follower brands flooding online marketplaces. This increased competition, especially from brands mimicking successful partnerships like Meta’s collaboration with Ray-Ban, poses a challenge to premium brands aiming to maintain their market position.

Maintaining Premium Status for Rings: The smart ring market, still led by a few select brands, faces the challenge of maintaining its premium status as the category grows. With increasing interest from new entrants, the challenge will be ensuring the market does not experience the same commoditization seen in other wearable segments.