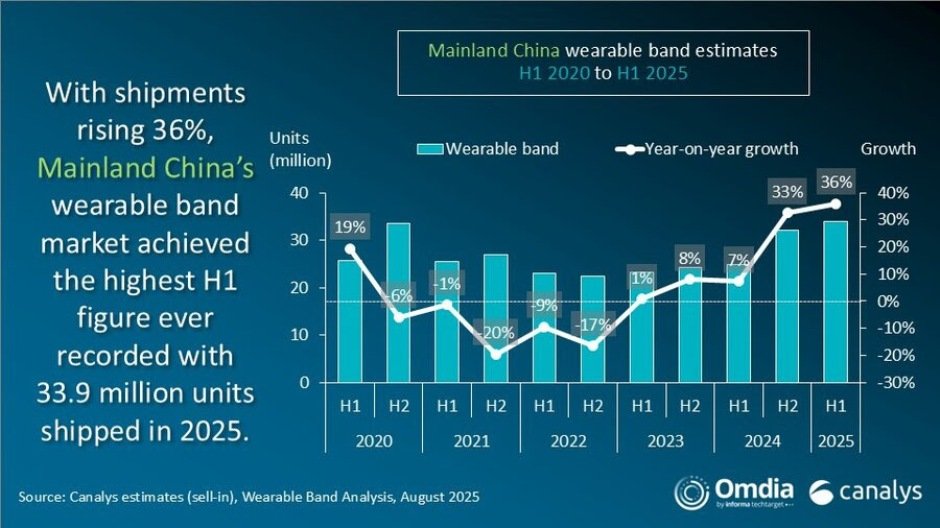

Shipments of wearable bands in Mainland China surged to 33.9 million units in H1 2025, according to Canalys (part of Omdia).

This represents 36 percent year-on-year growth, following a 33 percent increase in H2 2024, marking the highest H1 shipment volume ever recorded. For vendors, this growth signals a pivotal opportunity to expand portfolios, strengthen channel strategies, and tap into evolving consumer preferences, according to the latest Canalys report.

Market Leaders: Huawei and Xiaomi Set New Milestones

Huawei has maintained its leadership with around 12 million units shipped in H1 2025, capturing a 36 percent market share, while Xiaomi closely followed with 11 million units and a 32 percent share. Both vendors surpassed 10 million shipments for the first time in a half-year period, with Xiaomi’s shipments more than doubling, achieving 101 percent growth.

Basic bands were the standout category, expanding by 80 percent compared with Q2 2024, while premium segments such as sports watches also contributed more revenue despite smaller volumes. This growth highlights a significant shift from Q2 2024, when shipments were lower and vendor shares had not yet crossed the 10-million milestone, signaling accelerated momentum and intensifying competition in the Chinese wearable market.

Huawei’s Strategy: Leveraging its Watch GT lineup with advanced health management and premium coaching features, Huawei capitalized on subsidy policies that lowered prices below CNY1,000, boosting competitiveness in the basic watch segment.

Xiaomi’s Playbook: Doubling down on basic bands, Xiaomi focused on affordability, personalization, and fashion-led designs. Its ability to combine feature upgrades with budget-friendly pricing solidified dominance in the youth and entry-level segments.

Policy-Driven Growth: Subsidies and Promotions

China’s national subsidy policies, combined with the “618” shopping festival, fueled demand by reducing purchase barriers, Claire Qin, Research Analyst at Canalys (part of Omdia), said. The subsidies encouraged:

Upgrades from existing users

Adoption by first-time buyers

Re-engagement from former users

This environment has triggered the so-called “lipstick effect”—consumers trading up to higher-priced devices with enhanced designs and health functions, even within the CNY1,599–2,999 (US$400) price band.

Vendor Opportunities: Beyond Volume to Value

For vendors, the next growth wave lies in diversification and premiumization:

Comprehensive Portfolios: Brands with broader product lines (basic bands, smartwatches, and health-focused models) are best positioned to capture diverse consumer needs.

Premium Sports Watches: The sports watch category now accounts for 10 percent of market value with higher margins. Vendors like Garmin and Coros are already capitalizing, but others can enter with AI-driven coaching features, scenario-based guidance, and personalized fitness solutions.

Channel Optimization: Apple’s participation in subsidy programs in June highlights the importance of leveraging direct and online channels to remain competitive in the premium smartwatch space.

The Road Ahead for Vendors

With the National Health Commission’s “Year of Health Management” campaign boosting sports and fitness awareness, vendors must align products with health and lifestyle trends. Features such as AI coaches, personalized insights, and fashion-forward designs will play a decisive role in attracting new users while retaining existing ones.

Bottom line for vendors: The Mainland China wearable band market is not just about record volumes—it’s about seizing the opportunity to move consumers up the value chain, expand ecosystems, and strengthen brand loyalty in one of the world’s most dynamic markets.

Baburajan Kizhakedath