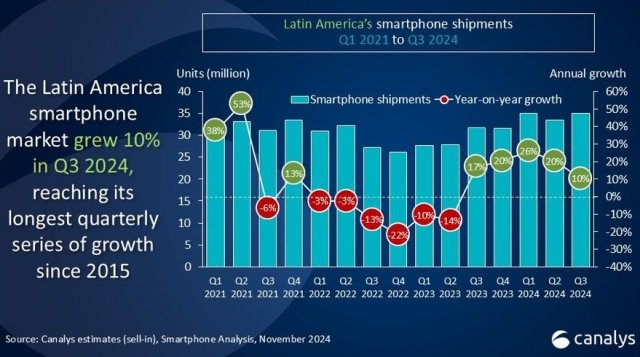

The Latin American smartphone market grew by 10 percent in Q3 2024, reaching 35.1 million units, marking the second-highest quarterly volume ever. Growth was driven largely by budget devices priced below US$200, which accounted for 49 percent of total shipments.

Samsung (11.3 million), Motorola (6 million), Xiaomi (5.8 million), Transsion (3.1 million), Oppo (1.9 million) are the leading smartphone brands in the Latin America in Q3 2024.

Samsung led the market with 11.3 million units shipped, showing a 16 percent growth. The company’s growth was primarily driven by the low-end A-series, which saw a 42 percent increase in shipments compared to Q3 2023. Samsung also maintained strong performance in the high-end segment, particularly with the Galaxy S24 series.

Motorola reclaimed the second spot despite flat growth, shipping 6.0 million units.

Xiaomi saw a slight decline of 1 percent, shipping 5.8 million units.

TRANSSION grew by 3 percent, shipping 3.1 million units.

OPPO made a strong return to the top five, experiencing a 62 percent growth with 1.9 million units shipped, boosted by expansion in Mexico and Colombia.

The budget segment remains fiercely competitive, with many vendors targeting devices priced below US$200 to gain market share. Samsung, Motorola, Xiaomi, and TRANSSION have all focused on delivering value-for-money propositions to defend or expand their positions.

While budget devices contribute to short-term gains, Canalys stresses the importance of broader portfolio performance, brand awareness, and higher profit margins for sustained success.

Vendors are preparing for strong sales in the holiday season, but market saturation and potential inventory issues pose risks. Q4 sales performance will be crucial in determining the market’s health going into 2025.

Overall, Q3 2024 showed strong growth for the Latin American smartphone market, particularly in the budget segment, with Samsung leading the charge and OPPO making notable gains. However, the market’s future depends on how vendors manage inventory and position themselves for the upcoming holiday sales peak.