The smartphone market in Southeast Asia faced a significant setback in the second quarter of 2023, as revealed by a recent report from Canalys research.

Shipments in the region plummeted by 15 percent year-on-year, with only 20.9 million units reaching consumers, marking the lowest shipment count since 2014. This downward trend, which has now persisted for six consecutive quarters, can be attributed to unfavorable macroeconomic conditions that have cast a shadow over the region’s smartphone industry.

Shipments in the region plummeted by 15 percent year-on-year, with only 20.9 million units reaching consumers, marking the lowest shipment count since 2014. This downward trend, which has now persisted for six consecutive quarters, can be attributed to unfavorable macroeconomic conditions that have cast a shadow over the region’s smartphone industry.

One of the major repercussions of this decline has been the accumulation of old stock, which has hindered the introduction of new products and initiatives by vendors. This, coupled with a lackluster festive season, has contributed to the overall stagnation in the market.

Analysts at Canalys, including Le Xuan Chiew, noted that smartphone brands in the region adopted a cautious approach during the quarter. The focus shifted towards fortifying channel positions for the sake of long-term sustainability in market share.

Apple, for instance, faced challenges in managing its inventory of non-pro iPhone 14 models and responded by intensifying its channel incentive efforts. Similarly, Samsung had to navigate through the normalization of its channel inventory, especially for its low and mid-range models, which experienced product cannibalization due to discounted old stocks causing unstable pricing and a cluttered product lineup.

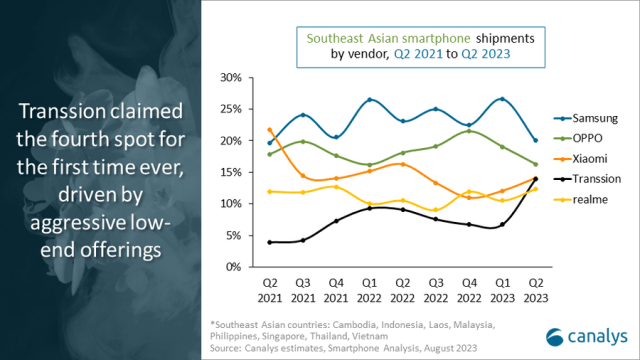

Interestingly, Transsion emerged as a standout performer during this period, experiencing a 31 percent growth and breaking into the top five vendors for the first time. The company employed aggressive channel incentives, particularly targeting Tier-2 cities. Sub-brands under Transsion, such as Infinix and Tecno, utilized strategies like free device bundles, rebates, and the release of affordable low-end models to drive their success.

Interestingly, Transsion emerged as a standout performer during this period, experiencing a 31 percent growth and breaking into the top five vendors for the first time. The company employed aggressive channel incentives, particularly targeting Tier-2 cities. Sub-brands under Transsion, such as Infinix and Tecno, utilized strategies like free device bundles, rebates, and the release of affordable low-end models to drive their success.

Despite a substantial year-on-year drop of 26 percent, Samsung managed to retain its leadership position in the Southeast Asia market by shipping 4.2 million units, which accounted for 20 percent of the market share. This success was attributed to the introduction of its new A-series models.

OPPO secured the second spot by shipping 3.4 million units, capturing 16 percent of the market share. OPPO’s efforts were centered around enhancing the visibility of its Find and Reno series and expanding its reach among operators in countries like Malaysia and Thailand.

Xiaomi and Transsion both held a market share of 14 percent, each shipping 2.9 million units. Xiaomi strategically leveraged the launch of its Redmi Note 12 series to drive sales, while Transsion focused on expanding its presence across multiple countries, solidifying its leadership in the Philippines. realme, with its successful new C-series launches, reclaimed the fifth spot by shipping 2.6 million units and capturing a 12 percent market share.

Le Xuan Chiew emphasized that the adoption of 5G technology played a role in mitigating the decline, particularly in markets driven by telecom operators like Thailand and Malaysia. Despite declines of 7 percent and 11 percent year-on-year in these markets, the growing telco channel cushioned the impact. The demand for affordable 5G devices remained robust, with brands like Samsung, OPPO, and vivo entering this segment with their respective 5G models.

As the market looks ahead to the second half of 2023, analysts such as Sheng Win Chow anticipate a rebound in momentum. With channel inventory expected to normalize, incentive programs ramping up, and the introduction of new high-end smartphone launches, retail sales are projected to increase from the third quarter onward.

Canalys maintains a positive long-term outlook for the Southeast Asian smartphone market, predicting mid-single-digit growth in 2024. The expansion of online channels is expected to be a significant growth driver, supported by investments in infrastructure by e-commerce operators. Moreover, increased marketing expenditure is poised to stimulate demand by enabling more aggressive pricing strategies. With an expanding middle-class and a young workforce entering the scene, the region is poised for an improved smartphone landscape in the coming years.