Smartphone shipments in the Philippines fell 3.1 percent year-on-year and grew 9.1 percent quarter-on-quarter to 4.3 million in Q2 2022, International Data Corporation’s (IDC) Quarterly Mobile Phone Tracker showed.

The number of smartphone shipments below $200 has improved significantly QoQ, as vendors such as Transsion and Cherry Mobile launched new models, but remained low on an annual basis, due to low demand and supply.

The number of shipments for models in the higher price categories slowed down as consumer spending declined due to economic headwinds, said Angela Medez, Market Analyst at IDC Philippines.

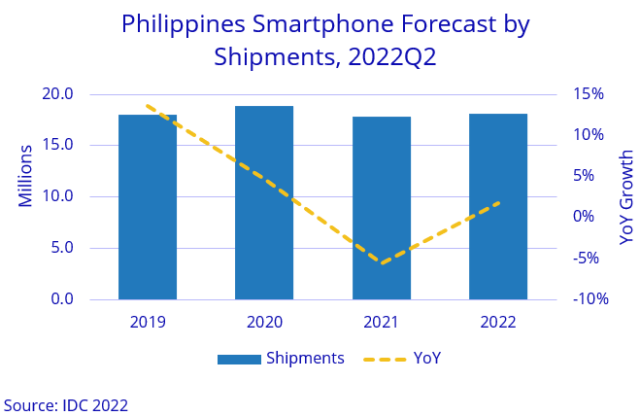

IDC expects 2022 will end with marginal growth of 2 percent, or flat compared to 2019.

Realme remained in first place with 21.8 percent share of the smartphone market in Philippines. Realme launched its TikTok store, live shopping session, and became the first smartphone brand to do so in the Philippines.

Transsion’s shipments rose by 152.2 percent YoY and 13.5 percent QoQ, capturing 20.5 percent of the Philippines market. Infinix’s retail expansion and marketing campaign catapulted the brand 3-fold YoY, accounting for nearly 60 percent of Transsion’s shipments. Lower consumer spending has benefited Transsion with an average selling price of $103, compared to $194 for the smartphone market.

Transsion’s shipments rose by 152.2 percent YoY and 13.5 percent QoQ, capturing 20.5 percent of the Philippines market. Infinix’s retail expansion and marketing campaign catapulted the brand 3-fold YoY, accounting for nearly 60 percent of Transsion’s shipments. Lower consumer spending has benefited Transsion with an average selling price of $103, compared to $194 for the smartphone market.

Xiaomi, accounting for 14.6 percent of the smartphone market, climbed to the third place, growing by 1.2 percent YoY and 12.1 percent QoQ. Its Redmi 10C drove the low-end portfolio ($100<$200), which made up 59.8 percent of its shipments and lowered its overall ASP to $167. Its sales through online channels drove growth.

Samsung dropped to fourth place, declining 23 percent QoQ and 12 percent YoY, accounting for 11.8 percent of the smartphone market in Philippines.

Samsung’s 5G smartphone market share grew 146.2 percent compared to last year, making up almost 40 percent of Samsung total shipments.

Vivo returned to the top five ranking with its hero models, the Y15s and Y15a, driving shipments. The launch of several models at different price points increased their ultra low-end segment (<$100) by 335.4 percent QoQ. Vivo hosted the first PUBG Turbo Cup Challenge, a mobile eSports championship.

Telecom operator PLDT recently announced plans to shut down their 3G network by 2023. This means, there will be faster migration from feature phones or older smartphones to newer models that support 4G or 5G. The number of 3G subscribers in the Philippines is less than 5 percent of total subscribers.