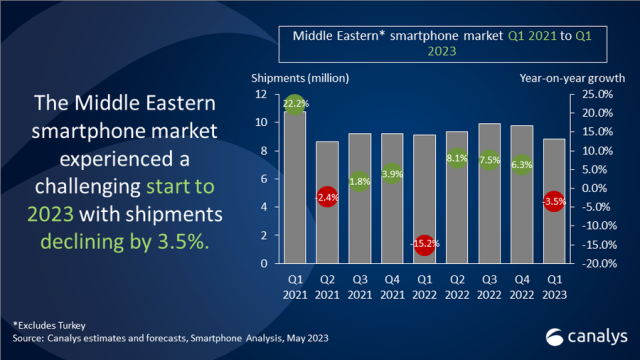

Smartphone shipments in the Middle East (excluding Turkey) fell 3.5 percent to 8.8 million units in Q1 2023, according to Canalys.

Despite the decrease, the Middle East region outperformed the global market, which experienced a 13 percent decline in shipments.

Despite the decrease, the Middle East region outperformed the global market, which experienced a 13 percent decline in shipments.

Though the nine-month growth streak in the region came to an end, the Middle East has emerged as the best-performing sub-region.

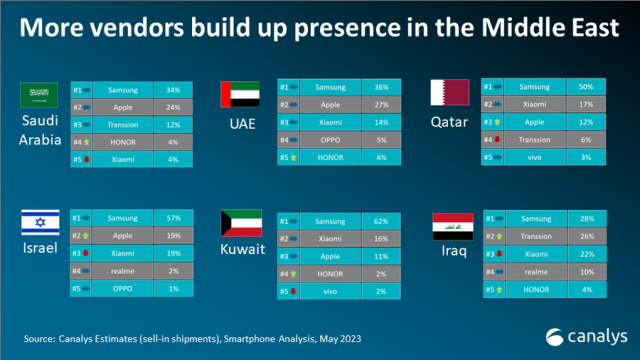

Samsung (3.8 million), Apple (1.3 million), Xiaomi (1 million), Transsion (0.9 million), Oppo (0.3 million), and others (1.5 million) are the leading smartphone brands in the Middle East region in terms of shipments during the first quarter of 2023.

The smartphone market in Saudi Arabia achieved a modest growth of 1 percent in terms of shipments, as consumers prioritized spending on food, beverages, and entertainment following the reopening of the economy.

The smartphone market in the United Arab Emirates (UAE) experienced a 3 percent year-on-year decline, despite economic expansion in the retail industry. Limited marketing spending hindered vendors from taking advantage of the growing trend.

The smartphone market in the United Arab Emirates (UAE) experienced a 3 percent year-on-year decline, despite economic expansion in the retail industry. Limited marketing spending hindered vendors from taking advantage of the growing trend.

In Iraq, a 3 percent annual decline in smartphones was observed due to lower demand, as consumers focused on conserving cash for essentials.

The smartphone market in Kuwait faced an 11 percent annual decline, with consumers holding onto newer upgrades.

The smartphone market in Israel experienced a remarkable growth of 26 percent driven by consumer demand for premium smartphones and the thriving tech industry, earning the region the nickname “start-up nation.”