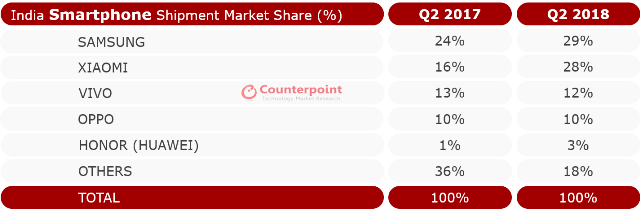

Samsung has regained the leading position in the Indian smartphone market with 29 percent share during the April-June 2018 quarter, beating China’s Xiaomi.

Samsung fell to the second spot in the October-December 2018 behind Xiaomi in the Indian smartphone market. Xiaomi is the number two smartphone player in India in the June quarter of 2018with 28 percent share, research report from Counterpoint said on Wednesday.

Samsung fell to the second spot in the October-December 2018 behind Xiaomi in the Indian smartphone market. Xiaomi is the number two smartphone player in India in the June quarter of 2018with 28 percent share, research report from Counterpoint said on Wednesday.

“The success of Samsung can be attributed to its refreshed J series as it launched the most number of models as compared to any brand across multiple price points during the quarter,” Counterpoint Research Analyst Karn Chauhan said.

Samsung’s strong offline distribution and aggressive marketing campaign around the J series helped the Korean company to gain market share during the quarter.

Xiaomi recorded its highest ever shipments in India during the second quarter with growth being driven by its strong product and supply chain strategy.

Vivo, Oppo and Honor had 12 percent, 10 percent and 3 percent share of the smartphone shipment, respectively, in the June quarter of 2018.

Apple had a slow quarter as the iPhone maker underwent changes in its distribution strategy in India.

“Apart from this, its domestic assembling is yet to pick up pace, which means the Cupertino giant is still relying on imports for its sales in India. Apple had 1 per cent market share during the quarter, its lowest in recent history,” Counterpoint said.

Research firm Canalys earlier said that Samsung shipped 9.9 million smartphones in India in the second quarter of 2018. Xiaomi also shipped 9.9 million smartphones, Canalys said.

The Canalys report noted that Samsung J2 Pro was the top model in the second quarter, with 2.3 million units shipped in India. In comparison, Xiaomi shipped 3.3 million units of its Redmi 5A smartphone in India.

“Despite Xiaomi’s growing popularity in India, Samsung will remain the first choice for consumers. Its technological prowess and supply chain mastery will continue to give it an edge over Xiaomi for the foreseeable future,” TuanAnh Nguyen, analyst at Canalys, said.