Thailand smartphone market declined 25.7 percent to 3.45 million during the first quarter of 2023, according to IDC.

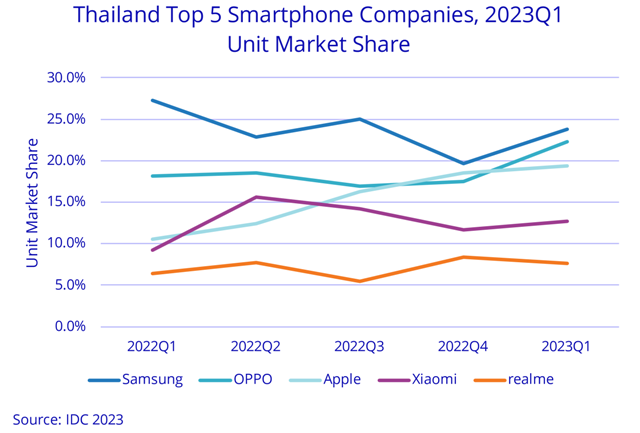

Leading phone suppliers in the Thailand smartphone market in Q1 2023 are: Samsung with 23.8 percent share as compared with Oppo (22.3 percent), Apple (19.4 percent), Xiaomi (12.7 percent), Realme (7.7 percent), and Others (14.2 percent), according to the IDC report.

Leading phone suppliers in the Thailand smartphone market in Q1 2023 are: Samsung with 23.8 percent share as compared with Oppo (22.3 percent), Apple (19.4 percent), Xiaomi (12.7 percent), Realme (7.7 percent), and Others (14.2 percent), according to the IDC report.

In Q1 2022, Samsung had 27.5 percent share in the Thailand smartphone market as compared with Oppo (18.3 percent), Apple (18.3 percent), Xiaomi (9.3 percent), Realme (6.5 percent), and Others (27.6 percent).

Smartphones in the entry-level segment (<US$200) in Thailand declined to 51 percent of the market, down from 60 percent in 4Q22 and 59 percent in 1Q22. The average selling price (ASP) in Thailand smartphone market increased to $403, rising 26 percent due to strong performance in the premium segment (US$800+), which had risen to 19 percent of the market compared to 11 percent in 1Q22.

In the premium segment, there was strong performance from the recently launched Samsung Galaxy S23 series, which was supported by attractive channel promotions. Furthermore, the iPhone 14 series remained strong due to carryover demand from 4Q22.

The share of 5G smartphones increased to 45 percent from 33 percent in 1Q22, driven by the increased share of shipments in the premium segment as well as the increased affordability of some 5G models in the lower-end segment.

“The Thailand smartphone market is expected to continue to decline in 2023. As the market is increasingly maturing, volume will be largely driven by the premium segment,” said Apirat Ratanavichit, Market Analyst at IDC Thailand.