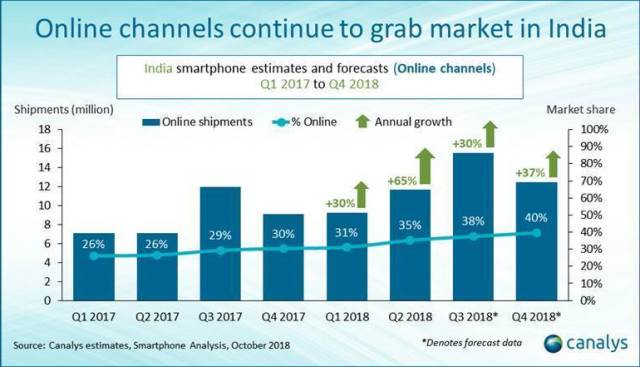

The online market for smartphones in India is set to sell 15 million (+25 percent) units in Q3 2018, expecting to account for 38 percent of the smartphone market.

Online channels such as Flipkart, Amazon, PayTm Mall, mi.com, OnePlus.com, etc. grabbed 35 percent (+65 percent) of the total smartphone sell-in to India by selling 11.7 million in Q2 2018.

Online channels such as Flipkart, Amazon, PayTm Mall, mi.com, OnePlus.com, etc. grabbed 35 percent (+65 percent) of the total smartphone sell-in to India by selling 11.7 million in Q2 2018.

Shipments sold directly via phone vendors’ websites accounted for 9 percent of all online shipments. Retailers such as Flipkart, Amazon, etc. took the remaining 91 percent.

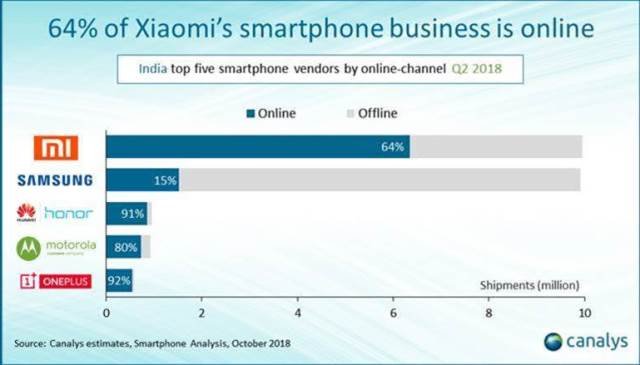

While almost all vendors in India have some sort of online presence, Xiaomi led the market, grabbing a commendable 54 percent, followed by Samsung with 13 percent and Huawei was third with 7 percent.

“Walmart’s acquisition of Flipkart and Alibaba’s investment into PayTM has infused much needed optimism in the industry, with smartphones being the most popular products sold on these platforms,” Canalys Analyst TuanAnh Nguyen said.

Flipkart and Amazon are expected to stimulate demand with aggressive offers at their October sales festivals. Xiaomi’s Pocophone and Oppo’s RealMe are expected to boost shipments in Q3 and Q4.

India’s widely independent retail network and fragmented offline retail has been a sticking point for most vendors looking to grow against dominant players like Xiaomi and Samsung.

India’s widely independent retail network and fragmented offline retail has been a sticking point for most vendors looking to grow against dominant players like Xiaomi and Samsung.

As of Q2 2018, 62 percent of smartphones were shipped to distributors in India and eventually resold to lower-tier channel partners and retailers.

Amazon shines

Amazon.in on Wednesday revealed the main sales trends during the first day of its Great Indian Festival 2018.

Xiaomi and OnePlus – saw their biggest single day sales ever on Amazon.in. Xiaomi sold more than a million devices in a single day. OnePlus achieved a record pre-booking of their new launch OnePlus 6T. The booking achieved by OnePlus was worth INR 400 crore.

Samsung sold 12X over average business day volumes with Galaxy S9 and Galaxy Note8 being the best-sellers.

Motorola sold more than 36X of a regular day’s sale in 36 hours – during the Amazon Great Indian Festival.

Phone strategies

Asus, whose Indian business was 100 percent distributor led until Q1 2018, revamped its go-to-market and moved to 100 percent online-only within months. Asus has since tripled its shipments sequentially in Q2 2018 and is bracing for a record performance in India in Q3 2018.

“There has been a marked shift in the go-to-market of various smartphone vendors in India and online retail is a big part of that change,” said Canalys Research Manager Rushabh Doshi.

There is no telecom statistics report that suggest the closure of retail shops or job loss in physical retail sector due to the emergence of online market places.

Baburajan K