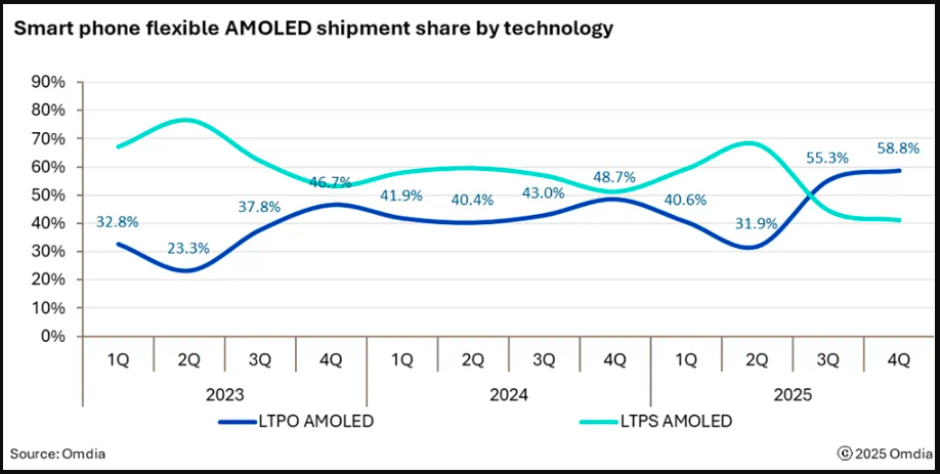

Shipments of LTPO (Low-Temperature Polycrystalline Oxide) flexible AMOLED displays are set to surpass LTPS (Low-Temperature Polycrystalline Silicon) flexible AMOLEDs in the second half of 2025, according to Omdia’s latest OLED Display Market Tracker.

The transition to LTPO technology reflects the growing dominance of flexible AMOLEDs in the smartphone display market. In 2024, AMOLED displays overtook TFT LCDs, capturing 51 percent of total smartphone display shipments, the Omdia report said.

Within the flexible AMOLED segment, demand for low-power, high-efficiency displays in premium devices is accelerating the shift from LTPS to LTPO. Shipment forecasts indicate LTPO’s market share will reach 55.3 percent in Q3 2025, growing to 58.8 percent in Q4 2025.

Apple’s iPhone lineup strategy is a key factor behind this market shift. In 2025, Apple released five new AMOLED iPhones, including the iPhone 16E and the iPhone 17 series, effectively phasing out the LTPS LCD-based iPhone SE. This has sharply reduced demand for TFT LCD panels while boosting overall AMOLED adoption. Notably, all four new iPhone 17 models, including the iPhone 17 and iPhone Air, feature LTPO flexible AMOLED, significantly increasing LTPO demand in H2 2025.

The trend is further strengthened by Chinese smartphone OEMs, which are expanding LTPO adoption from flagship models to the broader high-end segment. Several Chinese smartphone manufacturers have adopted LTPO flexible AMOLED technology in their devices, enhancing display performance and energy efficiency. Here are some notable brands:

Xiaomi 12 Pro

The Xiaomi 12 Pro features a 6.73-inch LTPO AMOLED display, offering dynamic refresh rates for smoother visuals and improved battery efficiency. This integration aligns with Xiaomi’s commitment to delivering high-performance smartphones with advanced display technologies.

Nothing Phone (2)

The Nothing Phone (2) is equipped with a 6.7-inch LTPO AMOLED display, providing users with an energy-efficient screen that adjusts its refresh rate based on content, enhancing battery life without compromising on display quality.

iQOO Neo 10 Pro+

The iQOO Neo 10 Pro+ boasts a 6.82-inch 2K AMOLED display with a 144Hz refresh rate, utilizing LTPO technology to deliver high refresh rates while optimizing power consumption. This makes it suitable for gaming and high-performance applications.

These devices demonstrate the growing trend among Chinese smartphone manufacturers to incorporate LTPO flexible AMOLED technology, balancing high display performance with energy efficiency.

From a panel supplier perspective, the surge in demand is expected to benefit Samsung Display, BOE, and Tianma, who are projected to see robust shipment growth.

Brian Huh, Principal Analyst at Omdia, notes, “As Apple completes its transition to LTPO AMOLED for flagship iPhones, Android brands are accelerating adoption to stay competitive. Chinese panel makers are aggressively promoting LTPO to capture market share, ensuring continued growth for LTPO AMOLED in the smartphone market.”

With premium smartphone adoption and energy-efficient display demand rising, LTPO flexible AMOLED is poised to dominate the smartphone display segment by the end of 2025.

Baburajan Kizhakedath