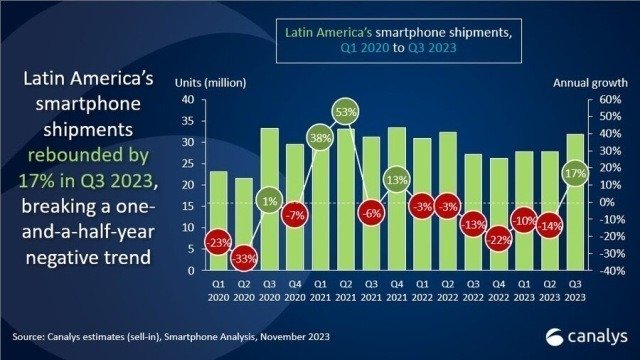

Canalys’ latest report on the Latin American smartphone market has unveiled a remarkable resurgence in Q3 2023, marking a turnaround from a prolonged period of decline. With a robust year-on-year growth of 17 percent, shipments surged to 31.8 million units, signaling a positive shift in the market landscape.

Market Leaders Maintain Positions

Market Leaders Maintain Positions

Top selling smartphone brands in Latin America include: Samsung 9.7 percent; Motorola 6 percent; Xiaomi 5.8 percent; Transsion 3 percent; Apple 1.3 percent; others with 5.9 percent.

Samsung maintained its dominance in Latin American smartphone market, capturing 31 percent of the market and witnessing a 2 percent annual growth. This achievement was bolstered by the expansion of its budget-friendly A-series and strategic inventory management.

Motorola secured the second spot in Latin American smartphone market despite a 2 percent decline, primarily attributed to challenges in its mid-to-high-end device segment.

Noteworthy performances were delivered by Xiaomi and TRANSSION, boasting impressive annual growth rates of 43 percent and 159 percent respectively in Latin American smartphone market.

Regional Dynamics and Key Performers

According to Miguel Perez, a Senior Consultant at Canalys, the growth in key markets like Brazil and Mexico was driven by improved economic projections and demand recovery. Xiaomi saw a resurgence in core markets such as Chile, Mexico, and Peru, while TRANSSION continued its success with niche-focused brands Infinix and Tecno. However, Apple experienced a decline of 9 percent year-on-year, rounding out the top five vendors with a 4 percent market share.

Rising Stars and Emerging Markets

Rising Stars and Emerging Markets

Chinese players like Xiaomi, TRANSSION, HONOR, OPPO, and ZTE emerged as standout vendors in Q3 2023. Xiaomi’s exceptional 43 percent growth marked its highest quarterly volume ever in Latin America, particularly driven by the success of specific models.

HONOR, leveraging a channel strategy akin to Huawei’s, made significant progress in the region with a 123 percent year-on-year growth. OPPO and ZTE also experienced considerable growth, recovering in key markets and displaying stronger performances.

Uncertain Future Despite Growth

While Q3 2023 showcased promising growth, Miguel Perez cautioned about potential volatility in the mid-to-long-term due to social and political uncertainties. Despite this, the trend is anticipated to lean toward growth, driven by the persistent need for smartphones. Perez emphasized the importance for vendors to focus on strategic planning, local profitability, robust inventory management, and nurturing channel relationships for long-term sustainability.

Outlook and Anticipated Trends

The forecast predicts a surge in the refresh cycle of low-to-mid-range devices bought in 2021, positioning 2024 as a critical year for vendors in Latin American smartphone market. Vendors eyeing long-term success are advised to prioritize strategic decisions over short-term gains to secure a stable footing in the evolving Latin American smartphone market.