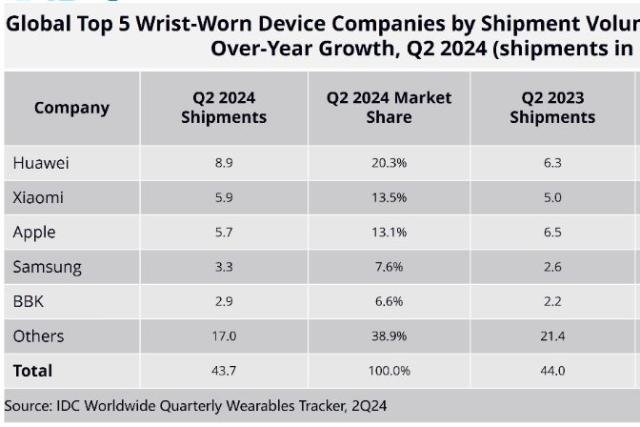

The global wrist-worn device market size has dropped 0.7 percent to 43.7 million units in the second quarter of 2024 (2Q24), IDC said.

China is the largest wrist-worn device market with 15.5 million units (up 10.9 percent).

The global smartwatch market size decreased 3.2 percent to 34.7 million units in 2Q2024. The size of the smartwatch market in China was 11.1 million units (up 18.7 percent).

The global wristband market size increased 10.6 percent to 9.0 million units in 2Q24. China has shipped 4.4 million units (down 4.8 percent) of wristbands.

The growth of the Chinese wrist-worn market is not only exceeding the global market, in the first half of 2024 Chinese manufacturers also maintained a rapid growth rate and a strong market position in the global wrist-worn market, IDC said.

Huawei

Huawei has achieved growth of 55.1 percent in wrist-worn device shipments in 1H24 with the launch of new wristbands and smartwatches.

Huawei has made progress in regions such as the Middle East and Africa, Latin America, and Central and Eastern Europe.

Huawei’s Fit 3 has played an important complementary role in its smartwatch product line, significantly driving the growth of its wrist-worn shipments. In addition, Huawei has been leading China’s wrist-worn market since 2021.

Xiaomi

Xiaomi has achieved significant growth and ranked second in terms of wrist-worn shipments despite the lack of new wristband products in 1H24. Xiaomi’s smartwatches have made breakthroughs in the entry-level and mid-range segments.

Redmi series has achieved growth in the entry-level segment with the coexistence of two generations of products, while the S3 watch has made breakthroughs with innovative designs.

The Watch 2 series has made progress in the development of high-end smartwatches. Xiaomi’s wrist-worn product line is expected to continue to grow with the launch of new wristband products in 2H24.

Apple

Apple’s smartwatches have been affected by price competition in the market, leading to a decline in shipments.

Apple still ranks first in the global smartwatch market, which also represents its iconic market position in product development and sales performance.

Apple’s next-generation smartwatches will be highly anticipated and are expected to boost its declining market performance.

Samsung

Samsung’s growth in the wrist-worn market mainly comes from its new wristband Galaxy Fit 3, which was launched at the beginning of 2024, effectively complementing its wristwear product line in terms of form, appearance, and price distribution.

Galaxy Fit 3 is mainly sold in developing regions, filling the gap in the local wristband market’s mid-to-high price segment and significantly increasing shipments. While Samsung’s 6th generation smartwatches are entering its late stages, the launch of new products is expected to drive future growth.

BBK

BBK’s significant growth in shipments mainly comes from the recovery of China’s kid’s watch market, which saw a significant increase in 1H24.

BBK has expanded its sales advantages in the Chinese market through channel efforts and differentiated pricing strategies.