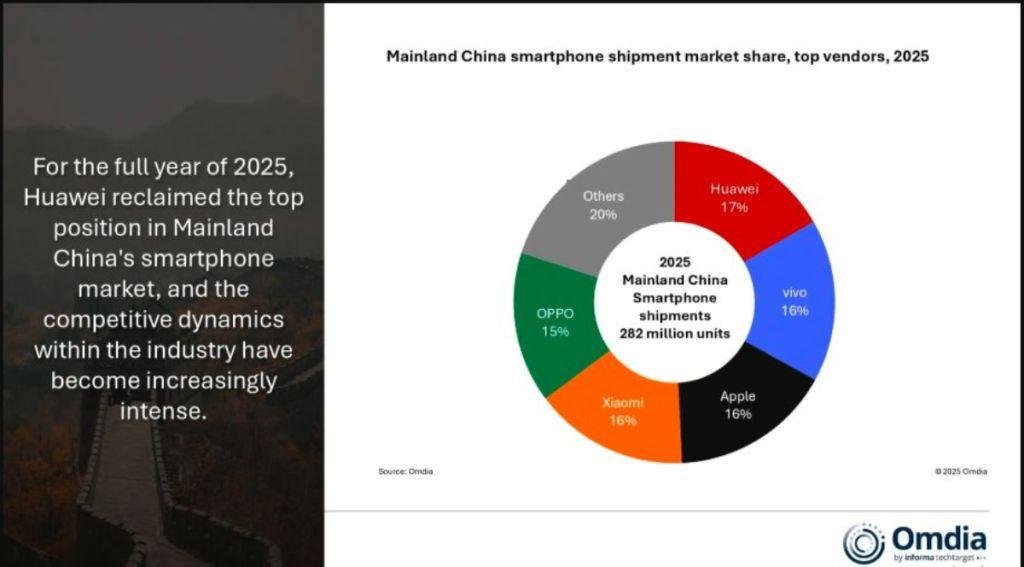

Omdia report said Huawei reclaimed the top position in mainland China’s smartphone market in 2025, shipping 46.8 million units and capturing a 17 percent market share. This performance positioned Huawei ahead of vivo, which shipped 46.0 million units (16 percent market share), and Apple, which maintained its top-three position with 45.9 million units.

Xiaomi and OPPO rounded out the top five, with shipments of 43.7 million and 42.8 million units, respectively. Overall, China’s smartphone market saw a slight year-on-year decline of 1 percent in 2025, totaling 282.3 million units.

In the fourth quarter of 2025, Huawei shipped 11.1 million units, ranking fourth behind Apple (16.5 million), vivo (11.9 million), and OPPO (11.6 million). The modest market decline of 1 percent YoY in 4Q25 was supported by year-end promotions and national subsidy policies, which helped stabilize shipments across leading brands.

Huawei’s Strategic Moves and HarmonyOS Push

Huawei’s strong performance is attributed to its continued investment in HarmonyOS and the AI ecosystem. Omdia highlighted that Huawei launched HarmonyOS 6 in October 2025 and committed RMB 1 billion to innovation in the platform, supporting both software and AI capabilities. This move reinforces Huawei’s premiumization strategy and its commitment to an integrated ecosystem, helping it compete effectively against Apple and other top-tier vendors.

Hayden Hou, Principal Analyst at Omdia, noted: “Local brands are advancing their premiumization strategies. Huawei’s HarmonyOS upgrade, combined with sustained hardware innovation, contributed significantly to its market leadership in 2025.”

Lucas Zhong, Analyst at Omdia, said: “The combination of national subsidy policies, strategic product launches, and channel readiness provides a stable foundation for smartphone market development in 2026, benefiting brands like Huawei that are focused on innovation and ecosystem integration.”

Market Context and Challenges

IDC report shows both Huawei and Apple maintained leadership positions by leveraging their premium brand value, even in a challenging cost environment.

Huawei shipped 46.7 million smartphones in 2025 grabbing market share of 16.4 percent. Apple shipped 46.2 million smartphones for market share of 16.2 percent. In 2024, Huawei shipped 47.6 million units (16.6 percent) vs Apple’s 44.4 million (15.5 percent).

Arthur Guo, Senior Research Analyst at IDC China, said: “With memory prices expected to rise sharply, cost pressures on smartphone OEMs will intensify, and the China smartphone market may experience a more noticeable decline in 2026.”

China’s smartphone shipments totaled approximately 285 million units in 2025, reflecting a slight 0.6 percent year-on-year decline. Rising memory costs and limited impact from government subsidy policies contributed to the slowdown, particularly affecting low-end model shipments.

Looking Ahead

Despite rising component costs, Huawei is sustaining investments in long-term growth drivers, including channel expansions, flagship store renovations, AI ecosystem development, and imaging technology innovation. Omdia predicts that 2026 will remain a year of value growth and product innovation in China, with Huawei well-positioned to maintain its competitive edge in the premium segment.

Huawei’s return to the top spot underscores its resilience in a market facing cost pressures and slowing overall demand, highlighting the importance of ecosystem strategy, premiumization, and long-term innovation in China’s smartphone landscape.

BABURAJAN KIZHAKEDATH