HONOR’s overseas business has emerged as a core growth engine, underpinned by strong shipment momentum, a clear shift toward mid-to-high-end smartphones, and a stratified regional strategy spanning Europe, Latin America, Middle East and Africa, and South-Eastern Asia, according to Omdia.

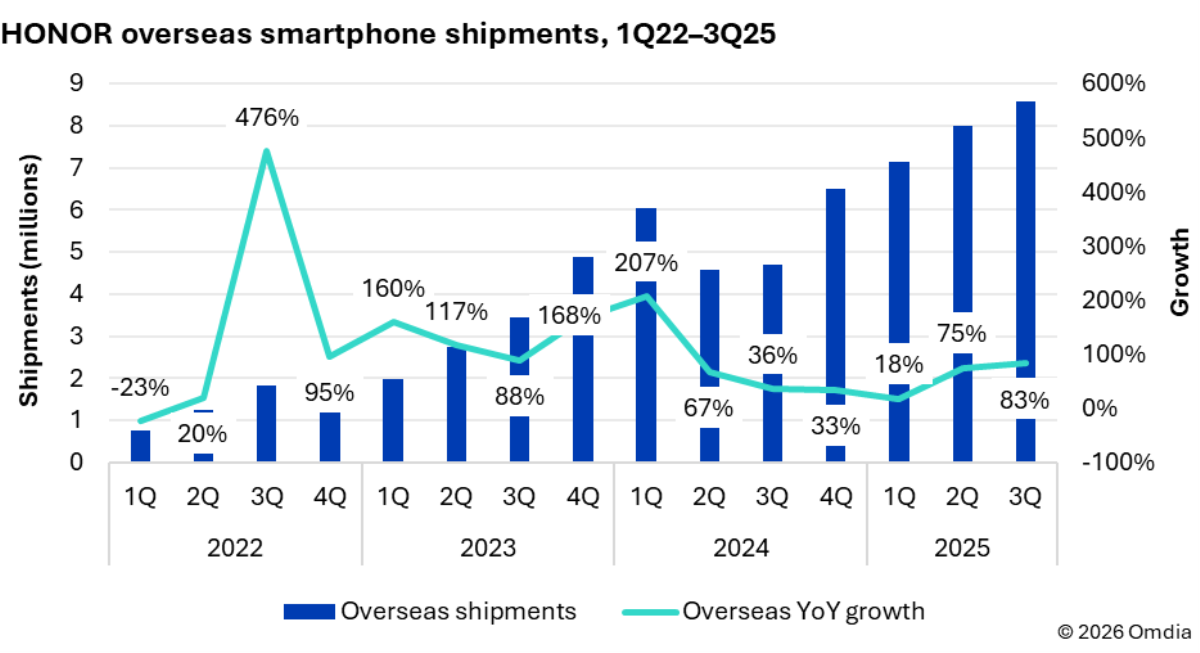

HONOR’s overseas shipments grew by about 55 percent year-on-year during 1Q to 3Q25, the strongest performance among the top 10 global smartphone vendors over the same period. International markets now account for nearly half of HONOR’s global shipments in 3Q25, compared with less than 10 percent in early 2021. This marks a structural inflection point, with overseas operations transitioning from a marginal contributor to a central pillar supporting scale, geographic diversification, and long-term resilience, Lucas Zhong, Analyst, Consumer Smartphone, said in the Omdia report.

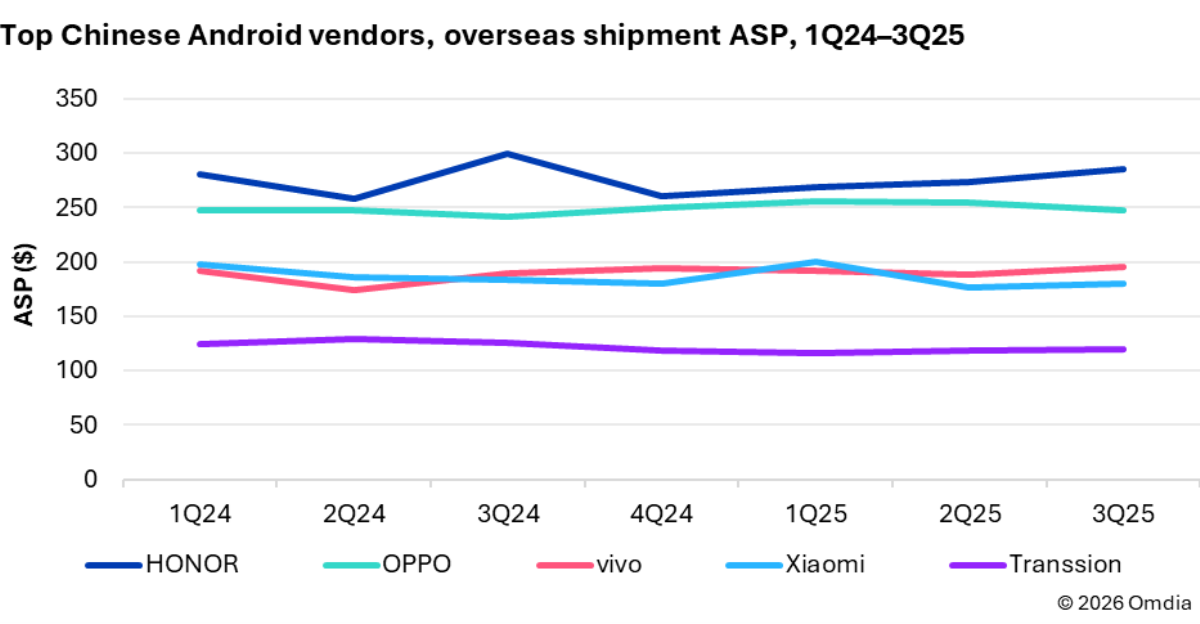

HONOR, which does not feature in the list of top five global smartphone brands, is deliberately avoiding the margin-constrained sub-200 dollar segment that dominates demand in many emerging telecom markets. Instead, it has prioritized the 300 to 499 dollar price band, which represented around 23 percent of its overseas shipments in the first three quarters of 2025, the highest share among major Chinese vendors. This positioning underscores a strategy centered on brand building, tighter channel control, and differentiated product value rather than pure volume expansion.

Execution is supported by a coordinated go-to-market model. Channel strategy emphasizes branded retail stores and key account partnerships to improve control over consumer engagement. Product strategy integrates local consumer insights, with differentiation built around battery life and durability, as seen in models such as X9d, HONOR 400, and Magic V5. On the marketing front, HONOR is moving beyond awareness-led campaigns by embedding AI feature education at the retail level, using in-store demonstrations to accelerate consumer understanding and adoption.

HONOR’s overseas expansion is guided by a clearly stratified regional strategy that balances premium brand building, volume scale, and new growth frontiers, supported by differentiated product positioning and localized execution.

Europe serves as the anchor for HONOR’s premiumization strategy. During 1Q to 3Q25, HONOR retained a top-five position in major Western European markets including the UK and France. The Magic V5 played a central role, helping HONOR secure second place in Western Europe’s book-style foldable segment through differentiation in slim design, battery performance, and integrated AI features. In parallel, HONOR is expanding its footprint in Central and Eastern Europe, where shipments rose by 15 percent in 1Q to 3Q25, reflecting increasing brand acceptance and channel penetration.

Latin America continues to function as the shipment backbone of HONOR’s overseas business. The company has consolidated its core presence in Mexico and Central America while steadily expanding across other Latin American markets, providing volume stability and scale to support broader international operations.

The Middle East and Africa region has emerged as the primary incremental growth engine, with total shipment volumes approaching those of Latin America. HONOR is strengthening its premium channel presence in Middle Eastern markets, while South Africa has delivered rapid growth, driven by strong operator partnerships and localized product specifications tailored to regional usage patterns.

South-Eastern Asia is developing into the next growth frontier. Progress in 2025 has been supported by the gradual buildout of local manufacturing and channel capabilities, alongside growing traction for HONOR’s flagship models. This phased investment approach positions the region as a medium-term growth driver as operational depth and brand recognition continue to improve.

HONOR’s Latin America strategy is closely aligned with the region’s operator-led channel structure, where telco partnerships play a decisive role in market access and scale. Core markets such as Mexico and Central America remain the foundation of regional operations, benefiting from HONOR’s accumulated experience in working with operators, which provides high execution certainty and supports scalable expansion.

Beyond its core markets, HONOR is diversifying growth drivers across the region. Ecuador has emerged as a notable incremental contributor as distribution broadens and local partnerships deepen. Smaller markets, including parts of the Caribbean, are also gaining relevance, strengthening the overall resilience of HONOR’s Latin American footprint and reducing reliance on a limited number of large markets.

Performance data underscores this momentum. By year-to-date 3Q25, shipments growth reached 48 percent in Central America with a 20 percent market share and second-place shipment ranking. The Caribbean recorded 122 percent growth, achieving a 16 percent share and third-place ranking. Ecuador delivered 89 percent growth with a 10 percent share, while Peru posted steady growth of 5 percent but maintained a strong 21 percent market share and third-place position. Mexico grew 7 percent with an 8 percent share, and Brazil, though still small at 1 percent share, recorded exceptional growth of 478 percent, signaling early-stage expansion potential.

Looking ahead, Latin America offers both near-term visibility and favorable structural tailwinds. The 2026 FIFA World Cup, cohosted by the US, Mexico, and Canada, is expected to stimulate consumer demand and operator-led promotions, creating a supportive environment for HONOR to further consolidate its presence and drive gradual portfolio up-trading across the region.

HONOR’s growth momentum in the Middle East is driven by a premium-focused channel strategy and disciplined go-to-market execution, taking advantage of the region’s relatively high purchasing power and mature retail infrastructure. This environment supports average selling price expansion and aligns closely with HONOR’s broader premiumization objectives.

The company has prioritized deep partnerships with operators, national electronics retailers, and branded retail formats to strengthen brand visibility and maintain pricing control, particularly across core Gulf Cooperation Council markets. Alongside these core markets, selected frontier markets are contributing incremental growth as HONOR expands distribution coverage and improves market access.

From a portfolio standpoint, the midrange segment remains the primary volume driver, while flagship models are used strategically to reinforce brand credentials and elevate perception within premium channels. This positioning is complemented by experiential retail initiatives, including flagship stores, dedicated demo zones, and in-store AI demonstrations, which enhance consumer engagement and help convert product differentiation into measurable ASP uplift.

Market performance data highlights the effectiveness of this approach. Iraq recorded 105 percent shipment growth with a 19 percent market share, ranking third. Qatar and Kuwait delivered rapid expansion, with shipment growth of 252 percent and 234 percent respectively, while Saudi Arabia and the UAE posted solid growth of around 30 percent each, all maintaining shipment rankings around fourth place. Collectively, these results underscore HONOR’s ability to translate premium channel focus into sustainable growth across the Middle East.

HONOR is positioning South-Eastern Asia as its next growth frontier by combining localization, manufacturing investment, and channel depth to support sustainable scale expansion and average selling price uplift. The strategy reflects rising consumer expectations in the region around product quality, service, and overall brand experience.

Indonesia is central to this approach, with HONOR investing in local production to improve supply resilience, optimize cost structure, and ensure compliance with regulatory requirements in the region’s largest smartphone market. This local manufacturing footprint strengthens execution certainty and supports long-term scalability.

Malaysia, in contrast, functions as a regional brand and service hub. The rollout of flagship retail stores and the expansion of service centers signal a deliberate push to enhance consumer touch points, aftersales capability, and brand trust, particularly in more mature South-Eastern Asian markets. Together, these investments anchor HONOR’s broader regional presence.

Market performance data indicates accelerating momentum across multiple countries. Malaysia recorded 40 percent shipment growth with a 12 percent market share, ranking fourth. The Philippines delivered 177 percent growth, Thailand 106 percent, Singapore 156 percent, and Vietnam 139 percent, all achieving mid-single-digit market shares and improving shipment rankings. These results suggest HONOR is gaining traction from a relatively small base.