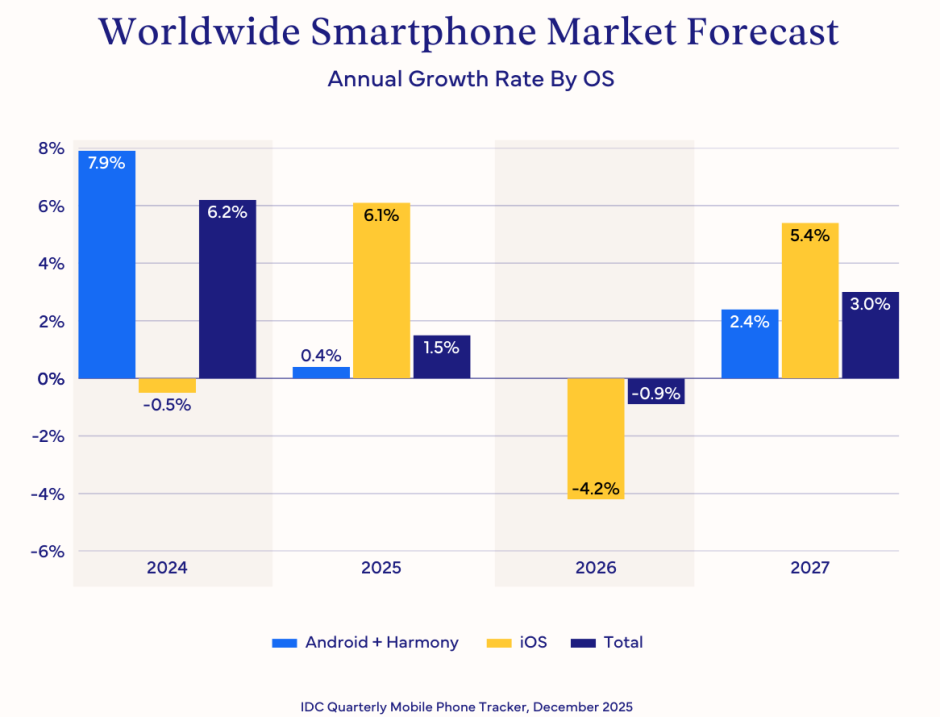

IDC said global smartphone shipments are now expected to decline 0.9 percent in 2026, compared to the previous forecast of 1.2 percent growth.

Worldwide smartphone shipments are expected to grow 1.5 percent year-on-year in 2025, reaching 1.25 billion units.

According to the latest IDC Worldwide Quarterly Mobile Phone Tracker, this marks an improvement from IDC’s earlier projection of 1 percent growth, driven by strong performance from Apple during the holiday quarter, rapid expansion in emerging markets and improving stability in China.

Apple Set for a Record-Breaking Year in 2025

Apple’s smartphone shipments are forecast to rise 6.1 percent in 2025, a sharp increase from the previous forecast of 3.9 percent.

“Apple is set to have a record year in 2025 with shipments expected to cross 247 million units, thanks to the phenomenal success of its latest iPhone 17 series,” said Nabila Popal, senior research director at IDC.

China, Apple’s largest market, has been a major driver of this surge. Massive demand for the iPhone 17 pushed Apple to the top position in October and November, capturing more than 20 percent market share, far ahead of rivals. IDC has revised Apple’s Q4 forecast for China sharply upward, from 9 percent growth to 17 percent growth year-on-year.

This momentum turns a previously expected 1 percent decline for Apple in China in 2025 into positive 3 percent growth. Similar success is seen across all regions, including the United States and Western Europe, where Apple had previously softened.

IDC also projects Apple’s shipment value to surpass 261 billion dollars in 2025, representing 7.2 percent year-on-year growth.

Market Challenges Expected in 2026

Despite the stronger outlook for 2025, IDC has downgraded its 2026 forecast. Global smartphone shipments are now expected to decline 0.9 percent in 2026, compared to the previous forecast of 1.2 percent growth.

Several factors are driving the revised projection:

Component shortages: Persistent global memory shortages are constraining supply and raising component prices.

Product cycle adjustments: Apple’s decision to shift the launch of its next base iPhone model from late 2026 to early 2027 is expected to reduce iOS shipments by 4.2 percent next year.

Pressure on Android vendors: The memory shortage is expected to hit low and mid-range Android devices hardest due to their price sensitivity.

Although units will decline, higher prices will push the average selling price (ASP) to 465 dollars in 2026, driving the total market value to a record 578.9 billion dollars.

“As memory components become more limited and more expensive, manufacturers face increasing pressure to raise prices,” said Anthony Scarsella, research director at IDC. He noted that vendors will need to revise strategies to protect market share. Some brands may raise prices, while others may pivot toward premium models with higher margins to offset rising bill of materials costs.

Outlook

IDC expects 2025 to be a pivotal year of recovery for the global smartphone industry, led by Apple’s exceptional momentum. However, 2026 will bring fresh challenges as supply constraints and product cycle shifts impact overall shipments. Even so, rising ASPs indicate that the market’s value trajectory remains strong.

Baburajan Kizhakedath