Global smartphone production climbed to 300 million units in Q2 2025, marking a 4 percent quarter-on-quarter (QoQ) and 4.8 percent year-on-year (YoY) increase, according to TrendForce.

The growth in smartphone production was fueled by seasonal demand, aggressive e-commerce promotions, and the rebound of key Chinese brands such as Oppo and Transsion after significant inventory adjustments.

Seasonal Demand and China’s Subsidy Boost

Analysts at TrendForce highlighted that China’s smartphone subsidy program during Q1 2025 briefly lifted mid- and low-end device sales and accelerated inventory clearance. However, due to its limited scope and eligibility criteria, the initiative is expected to have only a modest impact on full-year 2025 sales. Upcoming festive and online shopping seasons are projected to sustain smartphone production growth through the second half of the year despite ongoing global economic headwinds.

Market Share and Brand Performance

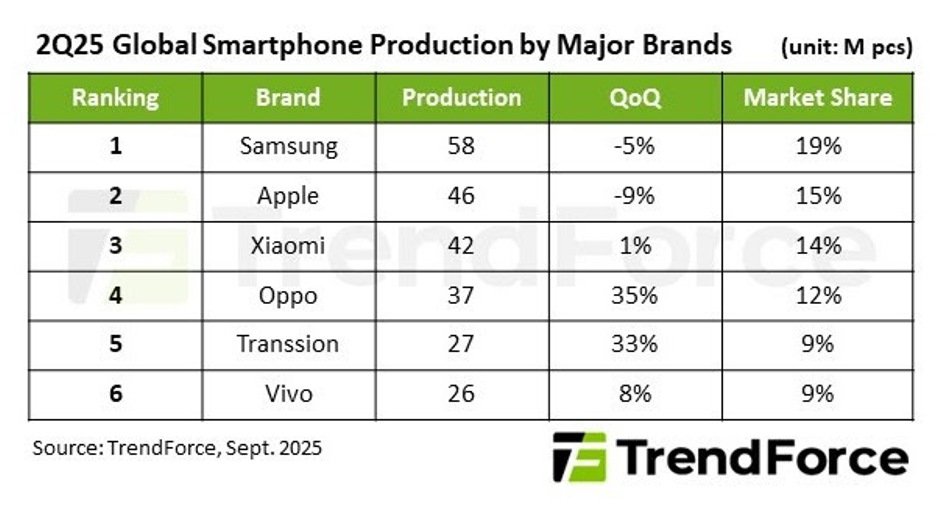

The top six smartphone vendors retained about 80 percent of global market share in Q2 2025:

Samsung stayed the market leader, shipping 58 million units, down 5 percent QoQ as demand for its flagship models cooled.

Apple ranked second with 46 million units, a 9 percent QoQ decline due to seasonal model transitions but still 4 percent higher YoY, buoyed by strong iPhone 16e sales earlier in the year. Apple’s deeper China discounts, combined with local subsidies, stabilized its market performance.

Xiaomi (including Redmi and POCO) secured third place with 42 million units, expanding across Latin America and Africa while benefiting from China’s subsidies.

Oppo (including OnePlus and Realme) surged 35 percent QoQ to nearly 37 million units after finishing inventory corrections, maintaining fourth position.

Transsion (TECNO, Infinix, itel) rebounded strongly, producing over 27 million units, up 33 percent QoQ and 15.7 percent YoY, ranking fifth thanks to robust demand in emerging markets.

Vivo (including iQOO) grew 8 percent QoQ to 26 million units, leveraging overseas expansion and Chinese subsidy support to claim sixth place.

Outlook for 2025

Despite macroeconomic challenges affecting consumer electronics demand, TrendForce forecasts steady growth for the remainder of 2025. Seasonal peaks and global e-commerce campaigns are expected to drive sequential production gains, with Chinese smartphone brands — particularly Oppo and Transsion — continuing to play a pivotal role in global market momentum.

Shafana Fazal