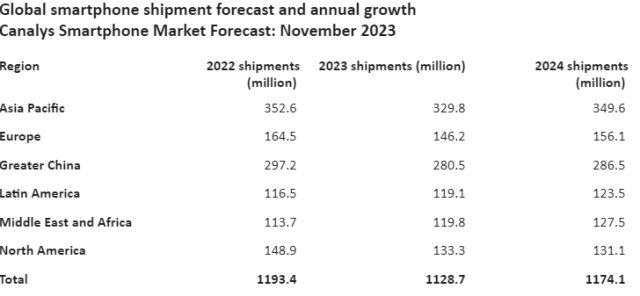

Canalys, a leading market research firm, forecasts a rebound in the global smartphone market, signaling a turnaround from its recent downturn. The report anticipates a rise from 2022’s 1193.4 million units to 1128.7 million in 2023 and further growth to 1174.1 million in 2024.

While 2022 saw a 12 percent decline, 2023 projects a 5 percent drop, indicating a gradual stabilization. Notably, regions like the Middle East, Africa, and Latin America show signs of resurgence, with anticipated growth rates of 9 percent, 3 percent, and 2 percent respectively this year.

While 2022 saw a 12 percent decline, 2023 projects a 5 percent drop, indicating a gradual stabilization. Notably, regions like the Middle East, Africa, and Latin America show signs of resurgence, with anticipated growth rates of 9 percent, 3 percent, and 2 percent respectively this year.

In Asia Pacific region, the number of smartphones shipped will be reaching 329.8 million in 2023 and 349.6 million in 2024 as against 352.6 million in 2022.

In Greater China, the smartphone shipment will be reaching 280.5 million in 2023 and 286.5 million in 2024 as against 297.2 million in 2022.

In Europe, the number of smartphones shipped will reach 146.2 million in 2023 and 156.1 million in 2024 against 164.5 million in 2022.

In Latin America, the number of smartphones shipped will reach 119.1 million in 2023 and 123.5 million in 2024 from 116.5 million in 2022.

In Middle East and Africa, the number of smartphones shipped will reach 119.8 million in 2023 and 127.5 million in 2024 against 113.7 million in 2022.

In North America, the number of smartphones shipped will reach 133.3 million in 2023 and 131.1 million in 2024 against 148.9 million in 2022.

Intriguingly, Canalys predicts a shift in consumer behavior, with smartphones gaining increased value. The average selling price has risen significantly, exceeding US$440, compared to US$332 in 2017. Toby Zhu, Senior Analyst at Canalys, highlighted this trend, stating, “Consumers are placing more value on their devices than ever before.”

Intriguingly, Canalys predicts a shift in consumer behavior, with smartphones gaining increased value. The average selling price has risen significantly, exceeding US$440, compared to US$332 in 2017. Toby Zhu, Senior Analyst at Canalys, highlighted this trend, stating, “Consumers are placing more value on their devices than ever before.”

Senior Analyst Sanyam Chaurasia emphasized the pivotal role of emerging markets in driving the rebound, citing their reliance on smartphones for connectivity, entertainment, and productivity. Notably, one in three smartphones shipped in 2024 is projected to be from the Asia Pacific, marking a substantial rise from one in five in 2017.

The Asia Pacific region is anticipated to witness robust growth, driven by resurging demand in India, Southeast Asia, and South Asia. Projections estimate 349.6 million smartphones shipped in 2024, reflecting a 6 percent year-over-year increase.

However, Canalys Analyst Runar Bjørhovde cautioned that on-device AI capabilities might not significantly drive high-end smartphone upgrades in 2024. He predicts that less than 5 percent of smartphones shipped next year will feature advanced AI-capable chipsets capable of running on-device AI models.

Moreover, with improving business conditions in 2024, Chinese smartphone players such as HONOR, TRANSSION, and Xiaomi are anticipated to aggressively expand beyond Greater China.

In summary, while the market is on the path to recovery, marked by stabilized declines and shifting consumer preferences, the landscape remains dynamic, with emerging markets and technological advancements driving the industry’s resurgence.