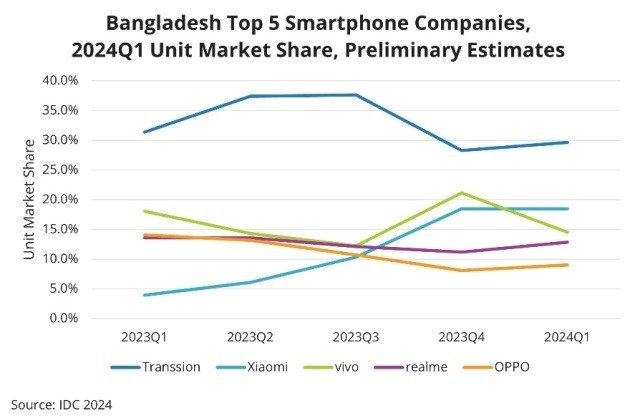

The smartphone market in Bangladesh has achieved 11.6 percent growth — shipping 1.8 million units in 1Q24, reversing a trend of six consecutive quarters of decline.

Analysts at IDC said this recovery of the Bangladesh smartphone market began in the third quarter of 2023 (3Q23) after the first half of 2023 (1H23) experienced a significant 39.4 percent decline due to heavy taxation from an International Monetary Fund (IMF) bailout.

Bangladesh’s overall mobile phone market — feature phones and smartphone — saw shipment of 4 million units in the first quarter of 2024 (1Q24), marking a growth of 1.7 percent, according to the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker. This follows a strong growth in the mobile phone market in the previous quarter (4Q23).

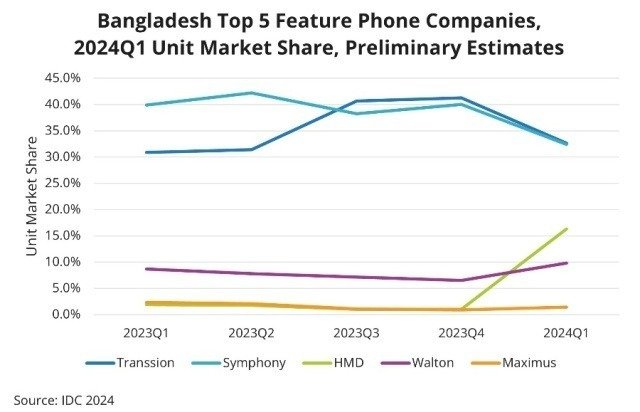

Feature phones, which make up 53.9 percent of shipments in Bangladesh, declined by 5.4 percent as consumers prioritized essential spending due to increased taxes affecting their disposable incomes.

The average selling price (ASP) of smartphones in Bangladesh increased by 3.9 percent, reaching $128 in 1Q24 after six quarters of decline.

Market Segment Highlights:

Entry-Level (Sub-$100): This segment declined by 6 percent to 33 percent share, down from 39 percent a year ago. Transsion led this segment with its itel and Tecno brands, followed by Symphony.

Mass Budget ($100-$200): Shipments grew by 18 percent, increasing to a 59 percent share from 56 percent a year ago. The top three companies — Xiaomi, Transsion, and Realme — accounted for 58 percent of this segment. Xiaomi’s growth surged after reopening its factory in 2Q23, replacing OPPO in the third position.

Entry-Premium ($200-$400): This segment’s share rose to 6 percent, up from 4 percent, with a 63 percent YoY growth. Xiaomi, Transsion, and OPPO dominated, holding nearly 78 percent of this market.

Mid-Premium ($400-$600): This sector comprised 1.4 percent of the market, with vivo leading with a 95 percent share.

5G Market and Government Initiatives: The share of 5G smartphones in Bangladesh remained low at 3.4 percent of total smartphone shipments, hindered by infrastructure and connectivity challenges. To address this, the Bangladesh Telecommunication Regulatory Commission (BTRC) issued a consolidated 5G license to major telecom operators to share infrastructure and set data retention standards.

Additionally, the Agency to Innovate (a2i) Bill was enacted in July 2023, establishing a2i as Bangladesh’s innovation department to support 5G development and ICT & IoT infrastructure. Despite these efforts, 5G smartphone shipments are expected to grow slowly, as 4G smartphones offer better specifications at lower costs.

Sales Channels: Offline channels continued to dominate, with e-tailers holding less than 1 percent of the market share. The preference for hands-on experience and discounts at retail stores like Salextra and Gadget & Gear presents a significant challenge for e-tailers such as Pickaboo and Daraz. However, the online channel saw a significant 74 percent growth in 1Q24, largely due to Daraz’s portfolio expansion with leading vendors.

Vendor Performance: Transsion led the market for the seventh consecutive quarter, with its Tecno brand accounting for 44 percent of its total shipments. The affordable Spark Go 2024 was the highest-shipped model.

Xiaomi experienced triple-digit YoY growth since reopening its plant in April 2023, driven by demand for models such as the Redmi 12, Redmi 13C, and Redmi Note 13 series. In the feature phone segment, Nokia (HMD) entered the market in 1Q24 and achieved triple-digit growth with new models like the 105 SS 2023 and 150 2023.