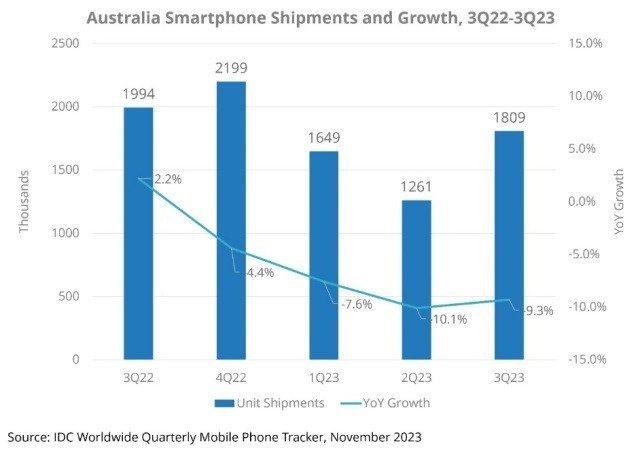

Australia’s smartphone market in the third quarter of 2023 experienced a notable 9.3 percent year-on-year (YoY) decline, shipping 1.81 million units, marking the fourth consecutive quarter of YoY decreases, IDC said.

Apple has increased its share to 52 percent from 49.7 percent in Australia’s smartphone market during Q3 2023.

Samsung has lost marginal share in Australia’s smartphone market to 28.9 percent from 29 percent.

Oppo has also lost marginal share to 5 percent from 5.1 percent in Australia’s smartphone market during Q3 2023.

HMD (Nokia) has 3.8 percent share in Australia’s smartphone market as compared with 3.8 percent in Q3 2022.

Lenovo has enhanced its share in Australia’s smartphone market to 3.3 percent from 2.5 percent.

Key highlights from the report include:

Sales Trends: Despite a slight uplift in July attributed to end-of-financial-year sales, overall consumer demand remained subdued due to economic instability, contributing to the sustained decline in smartphone shipments, the latest data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker reveals.

Average Selling Price (ASP): The ASP surged by 5.1 percent YoY in 3Q23, reaching US$813. Notably, smartphones priced above US$1000 witnessed growth, primarily driven by the recent releases of flagship series such as the Samsung Galaxy Z5 and Apple iPhone 15.

New Market Entrants: Low- to mid-price brands such as OPPO and Lenovo introduced new models during the quarter, contributing to successful sales in open channels and the prepaid market.

Vendor Positioning: The rankings of the top five smartphone vendors remained relatively stable, with minor shifts observed between HMD and Lenovo, similar to the previous quarter.

“Economic uncertainty is prompting consumers to exercise caution in their spending habits, resulting in restrained demand for smartphones. The ongoing rise in interest rates, coupled with recent cost-of-living pressures, is anticipated to further dampen consumer demand within the domestic market,” Yash Gupta, Lead Analyst for Mobile Phone Research at IDC Australia, said.