Apple reported blockbuster first quarter results for fiscal 2026, with total revenue of $143.8 billion, up 16 percent year-over-year, and earnings per share of $2.84 — both all-time quarterly records, driven by extraordinary demand for its iPhone lineup and expanding services business.

India emerges as a key growth market

Apple highlighted significant expansion in India during the quarter, setting quarterly revenue records for iPhone, Mac, iPad and services in the December period, as adoption continued to rise sharply. Management said the majority of customers buying Apple products in India were new to those products, signaling deepening market penetration.

Double-digit revenue growth and strong installed base expansion in India were emphasized by CFO Kevan Parekh as particularly encouraging, underscoring India’s role within Apple’s broader emerging markets strategy.

Apple CEO Tim Cook, announcing the financial result, noted India’s importance as the second-largest smartphone market globally and the fourth-largest PC market, yet pointed out Apple still holds a relatively modest share, suggesting a substantial runway for future growth. “We opened our fifth store in India in December and have plans to open another store in Mumbai soon,” Tim Cook said.

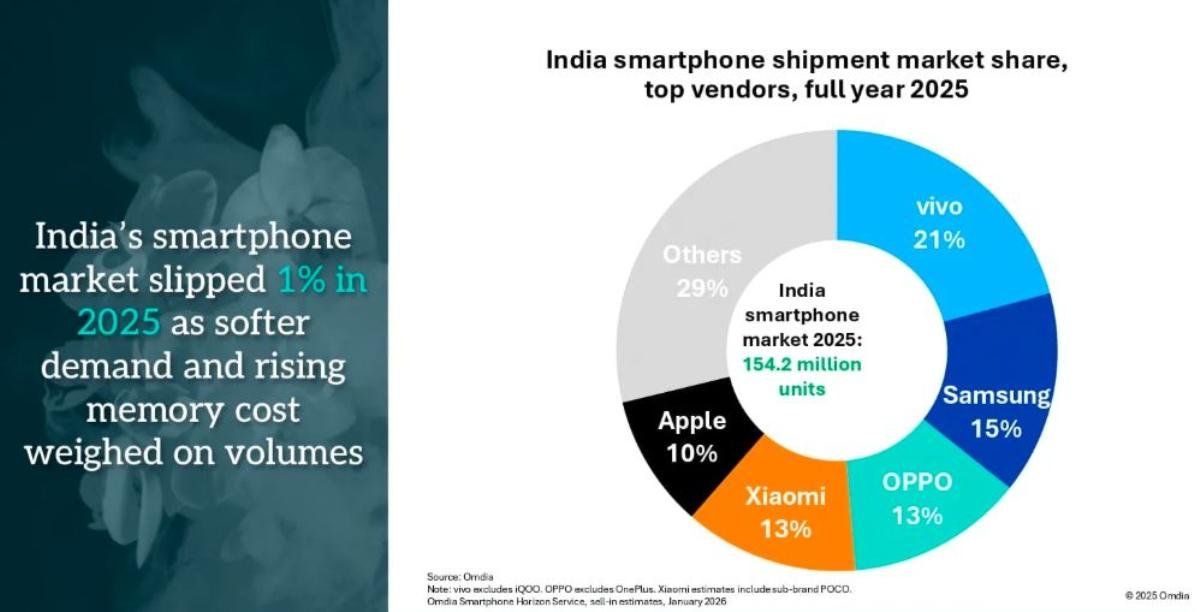

Outside of the latest earnings call, industry reports have shown Apple shipped a record number of iPhones in India in 2025, evidencing sustained consumer demand even as the larger smartphone market remained broadly flat.

Omdia report said Apple shipped 3.9 million iPhones in India in Q4-2025 vs 4 million in Q4-2024. Apple’s India smartphone market share was 11 percent in both Q4-2025 and Q4-2024.

In 2025, Apple shipped 15.1 million iPhones for 10 percent share vs 11.8 million iPhones for 8 percent share in 2024.

“Apple’s performance in India remained broadly flat with strong demand for the iPhone 17 base model, as consumers deferred purchase in anticipation of demand-generation offers on the iPhone 15 and 16 from January onwards,” Sanyam Chaurasia, Principal Analyst at Omdia, said in a research note on January 20, 2026.

Apple’s global user base now tops about 2.5 billion active devices, with India cited as a notable contributor to this expansion, reflecting the company’s growing footprint in the country.

Products and services driving results

Apple’s latest iPhone models, particularly the iPhone 17 family, powered the company’s strong performance, setting an all-time revenue record of $85.3 billion in the quarter. Services revenue also reached new highs, supported by growth in advertising, cloud services, music and payment services.

Despite supply chain constraints and rising memory costs, Apple forecasted further revenue growth for the March quarter, with continued gross margin strength.

Outlook for India

With solid momentum in the December quarter, India is positioned as one of Apple’s fastest-growing markets outside of Greater China and the US, backed by rising device adoption, expanding retail presence and the appeal of Apple’s ecosystem. Analysts see this trend as part of a broader strategy to capitalize on demand in large emerging economies.

Apple Pay eliminated more than $1 billion in fraud for partners last year. Last year, Apple welcomed more than 850 million users every week on average to the App Store app marketplace. Developers have earned more than $550 billion on the platform since 2008.

BABURAJAN KIZHAKEDATH