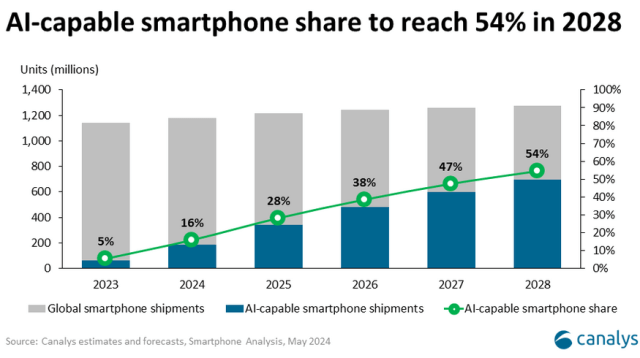

A Canalys report said the number of AI-capable smartphones will represent 54 percent of the total smartphone market in 2028 against an anticipated 16 percent in 2024.

The AI-capable smartphone segment is growing at a 63 percent CAGR (2023-2028) driven by consumer demand for enhanced functionalities such as AI agents and on-device processing. This shift is anticipated to occur first among premium models, with a gradual adoption in mid-range smartphones.

The AI-capable smartphone segment is growing at a 63 percent CAGR (2023-2028) driven by consumer demand for enhanced functionalities such as AI agents and on-device processing. This shift is anticipated to occur first among premium models, with a gradual adoption in mid-range smartphones.

Samsung, announcing its financial result for the first quarter of 2024, said Galaxy AI features in the S24 — its first AI-enabled smartphone — have seen continued high usage rates and contributed to sales expansion.

Samsung also revealed it will expand AI experience to other flagship smartphone models and maximize product competitiveness. Samsung aims to strengthen customer communication around S-series’ AI functionality and continue investments to advance Galaxy AI.

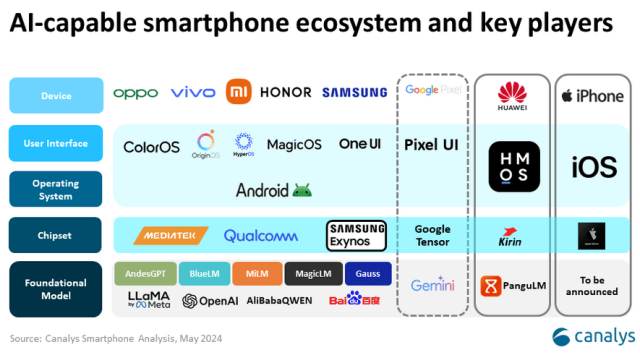

Canalys said major global players such as Apple, Google, and Samsung, as well as leading Chinese players HONOR, OPPO, Xiaomi and Vivo are at the forefront of integrating AI capabilities into their devices.

Canalys said major global players such as Apple, Google, and Samsung, as well as leading Chinese players HONOR, OPPO, Xiaomi and Vivo are at the forefront of integrating AI capabilities into their devices.

Xiaomi recently said the proportion of premium smartphone shipment represented 21.7 percent of its total smartphone shipments during the first quarter. Xiaomi has revealed its plans to enhance AI-driven consumer experience by focusing on premiumisation, smartphone AIoT, generative AI and 5G smartphones.

The strategies of main smartphopne suppliers vary from developing proprietary AI chips to enhancing ecosystem integrations that leverage AI for improved user experiences. These developments are technical and strategic, involving significant investments in hardware and software to maintain a competitive edge.

The report several core hardware capabilities are essential in defining AI-capable smartphones. Specialized processors such as ASICs, GPUs, and other components should be optimized to effectively run on-device AI models and workloads.

As technology progresses, software and service capabilities will play an increasingly crucial role, differentiating AI smartphones not only by their hardware but also through their ability to seamlessly integrate and update AI-driven functionalities.

Integrating on-device AI opens opportunities for revenue generation beyond traditional smartphone sales. On-device AI enables new business models, including subscription-based services for premium AI features, personalized advertising, and enhanced app functionalities that leverage on-device processing. These models diversify revenue streams and drive deeper customer engagement by offering continuously improving and personalized user experiences.

Clear communications regarding data usage, the functionality of AI features, and adherence to privacy regulations are critical in building consumer trust and acceptance. Addressing these concerns directly can mitigate apprehension and foster a more receptive market environment, The Canalys Consumer AI Inclination Index said.

Baburajan Kizhakedath