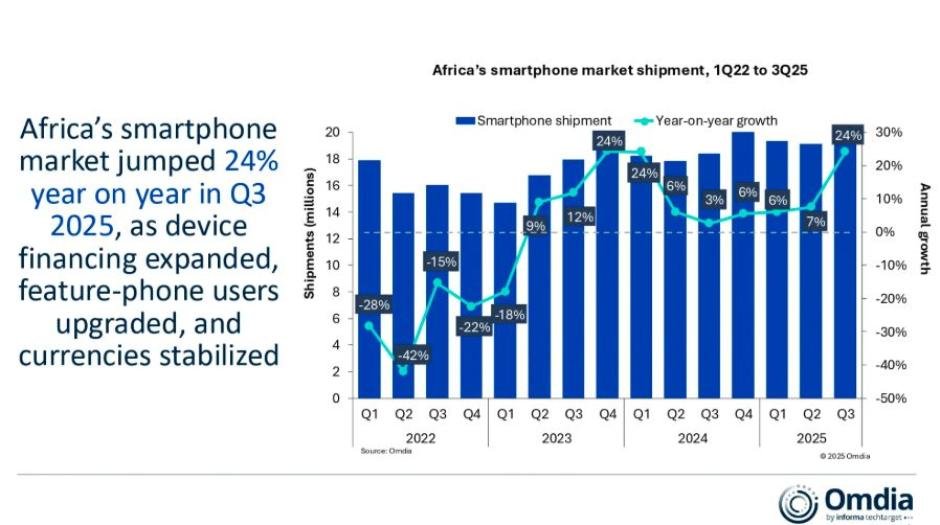

Africa’s smartphone market returned to high growth in the third quarter of 2025, with shipments rising 24 percent year on year to 22.8 million units, according to new research from Omdia.

This sharp rebound in Africa’s smartphone market follows five consecutive quarters of slowdown and outpaced the modest recovery seen in global shipments. Demand for smartphones strengthened across major telecom markets as currency conditions stabilised, financing options expanded, and retail activity improved, Manish Pravinkumar, Principal Analyst at Omdia, said.

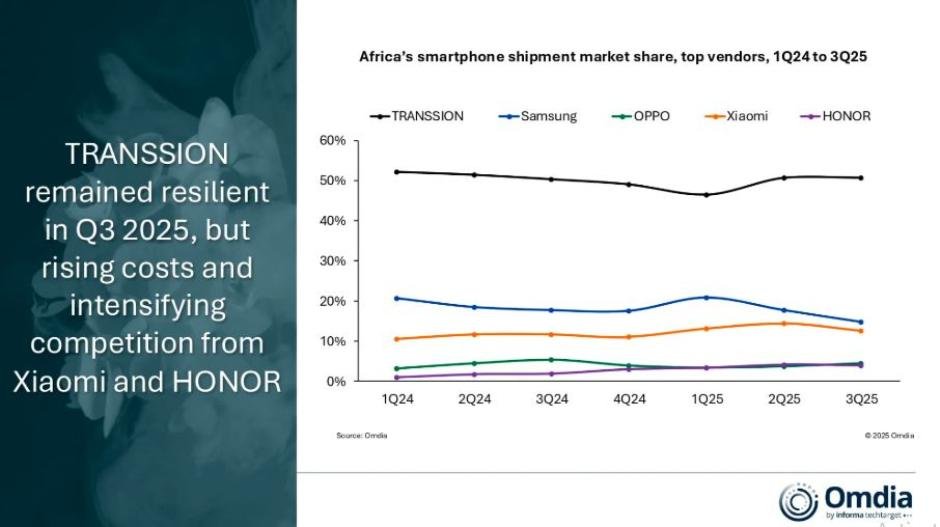

Transsion (11.6 million), Samsung (3.4 million), Xiaomi (2.9 million), Oppo (1 million), Honor (0.9 million), and Others (3.1 million) are the leading smartphone brands in Africa.

Most countries across North and Sub-Saharan Africa recorded strong double-digit shipment growth, with Algeria the only major market growing at 4 percent. Nigeria and Egypt each contributed 14 percent of regional shipments but benefited from different drivers. Nigeria saw a 29 percent surge as vendors increased imports following the Naira’s stabilisation and refreshed their sub USD 150 portfolios, prompting rapid upgrades in open-market retail. Egypt grew 19 percent as mid-range models between USD 150 and USD 250 gained traction through bundled offers and wider mass-market distribution.

South Africa delivered the strongest expansion at 31 percent, powered by prepaid demand in value and mid-tier segments. Aggressive promotions from retailers such as Pepkor and Ackerman’s played a key role, boosted further by the removal of the 9 percent ad valorem tax earlier this year. Kenya grew 17 percent year on year as device financing became a central driver of purchase decisions, with operators and retailers scaling instalment plans that supported rising demand for updated entry-level smartphones.

Omdia data shows that Africa recorded a rare dual surge in Q3, with sub USD 100 smartphones climbing 57 percent and the above USD 500 tier rising 52 percent. TRANSSION remained the dominant force in the entry tier, achieving 25 percent year-on-year growth supported by demand for refreshed hero models including TECNO Camon 40 and Spark 40, Infinix Hot 60 and Smart 10, and itel A90.

Samsung led the premium tier with strong Galaxy S24 and S24 FE 5G traction across South Africa, Senegal, and Algeria, although overall growth for the brand remained modest at 5 percent as consumers shifted toward value-focused A-series models.

Xiaomi continued to accelerate its long-term strategy for the region, preparing expansion into over 15 additional markets and opening its first directly owned branded store in Morocco. Its performance remained anchored in the sub USD 150 category, driven by high shipments of the A5 4G and Redmi 15C 4G. OPPO reinforced its North African presence with Egypt as a strategic hub, while HONOR maintained solid momentum in South Africa through value-led devices such as the HONOR 200 Lite.

Looking ahead, Omdia expects Africa’s smartphone market to decline 6 percent in 2026 as supply-side pressures intensify. Rising bill of materials costs, memory constraints, higher shipping and insurance fees, and ongoing currency weakness are likely to strain the low-end 4G segment, which represents the bulk of Africa’s demand. These challenges will push average selling prices higher, particularly in the USD 80 to USD 150 range, heightening affordability concerns. Vendors that strengthen financing partnerships, improve channel efficiency, and localise more operations will be best positioned to maintain upgrade cycles amid the tougher economic environment.

Baburajan Kizhakedath