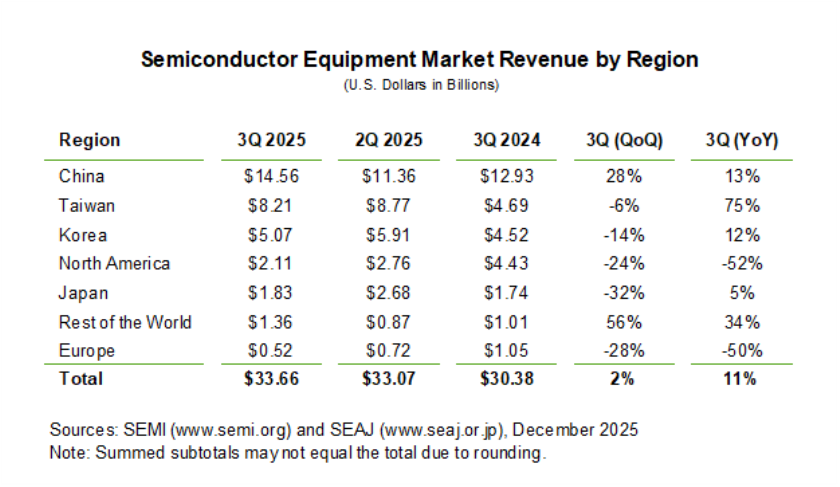

Global semiconductor equipment billings climbed to US$33.66 billion in the third quarter of 2025, rising 11 percent year-over-year.

The top semiconductor equipment markets in terms of billings are China ($14.56 billion), Taiwan ($8.21 billion), Korea ($5.07 billion), North America ($2.11 billion), Japan ($1.83 billion), Rest of the World ($1.36 billion) and Europe ($0.52 billion) in Q3-2025.

According to the latest Worldwide Semiconductor Equipment Market Statistics (WWSEMS) Report from SEMI, the semiconductor equipment industry recorded a 2 percent increase compared to the previous quarter, signaling sustained momentum as the sector continues to benefit from strong demand for advanced technologies.

SEMI reported that billings have reached nearly US$100 billion year-to-date – the highest level ever for the first three quarters. This reflects capital investments across the semiconductor manufacturing ecosystem.

Ajit Manocha, President and CEO of SEMI, said the continued uptrend is powered by surging demand for AI-driven innovation. “Strong AI demand continues to drive spending in advanced logic and memory segments, and in packaging applications geared toward energy efficiency. This positive trajectory underscores the critical role semiconductors play in shaping a smarter and more connected world that powers next-generation digital solutions,” Ajit Manocha said.

A significant share of the quarterly growth came from robust investments in leading-edge logic, DRAM, and advanced packaging solutions designed for AI computing workloads. Shipments of semiconductor manufacturing equipment to China also saw a notable increase, adding to the global expansion.

The WWSEMS Report is compiled using monthly billings data submitted by SEMI members and the Semiconductor Equipment Association of Japan (SEAJ). It offers a consolidated view of worldwide spending on semiconductor production equipment, highlighting investment trends across regions and technology segments.

With AI, cloud, and high-performance computing driving rapid transformation across industries, the semiconductor equipment market is expected to maintain its growth trajectory as manufacturers scale capacity to meet future digital infrastructure needs.

Baburajan Kizhakedath