United Microelectronics Corporation (UMC), a global semiconductor foundry, reported first quarter revenue of NT$54.2 billion ($1.78 billion).

UMC revenue fell 20.1 percent QoQ from NT$67.8 billion in 4Q22 and declined 14.5 percent YoY from NT$63.4 billion in 1Q22.

UMC revenue fell 20.1 percent QoQ from NT$67.8 billion in 4Q22 and declined 14.5 percent YoY from NT$63.4 billion in 1Q22.

UMC reported gross margin of 35.5 percent despite lower utilization and net income of NT$16.2 billion, with earnings per ordinary share of NT$1.31.

Jason Wang, co-president of UMC, said: “Our business was impacted by sluggish wafer demand as customers continued to digest elevated inventory levels.”

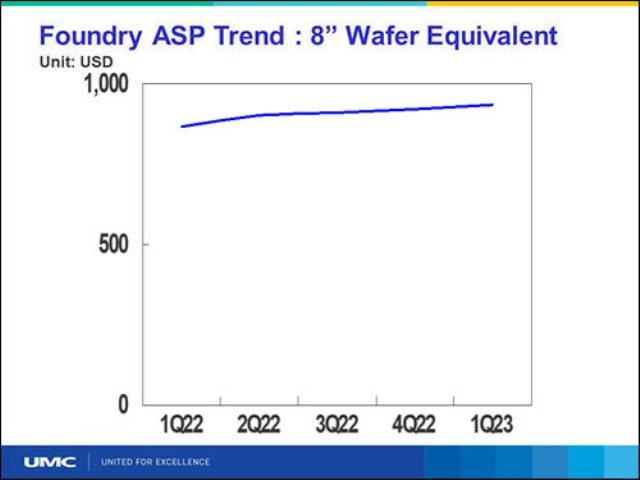

UMC said wafer shipments fell 17.5 percent QoQ and utilization rate dropped to 70 percent, while average selling price stayed firm.

Automotive sales accounted for 17 percent of first quarter revenue. Automotive will be a significant revenue contributor and key growth driver for UMC going forward, as IC content in cars continue to increase driven by electrification and autonomous driving.

UMC has invested in a number of initiatives over the years to minimize the environmental impact of its operations, such as increasing the reuse rate of resources in fabs.

Last month, UMC announced it will be building the Circular Economy & Recycling Innovation Center at its Fab 12A for NT$1.8 billion. The new facility, which will process semiconductor manufacturing waste into value-added products that can be reused or sold, is expected to reduce waste from UMC’s Taiwan manufacturing sites by one-third.

Last month, UMC announced it will be building the Circular Economy & Recycling Innovation Center at its Fab 12A for NT$1.8 billion. The new facility, which will process semiconductor manufacturing waste into value-added products that can be reused or sold, is expected to reduce waste from UMC’s Taiwan manufacturing sites by one-third.

UMC said revenue from Asia-Pacific declined to 50 percent while business from North America was 31 percent of sales. Business from Europe increased to 11 percent while contribution from Japan was 8 percent.

UMC said revenue from the communication segment represented 44 percent, while business from computer applications decreased to 9 percent. Business from consumer applications was 24 percent as other segments grew to 23 percent of revenue.

UMC’s Capex spending in 1Q23 totaled US$998 million. 2023 cash-based CAPEX budget will be US$3.0 billion.

UMC said capacity in the first quarter decreased to 2,522K 8-inch equivalent wafers. Capacity will grow in the second quarter of 2023 to 2,626K 8-inch equivalent wafers, primarily representing the capacity expansion at 12A facility.