Marvell Technology, a provider of data infrastructure semiconductor solutions, has revealed its financial performance for the third quarter of fiscal year 2024. Despite challenges, the company demonstrated resilience and strategic adaptation across various business units.

Financial Overview:

Revenue Figures: Marvell Technology’s third-quarter revenue for fiscal 2024 amounted to $1.419 billion, marking a dip of 8 percent from previous periods.

Net Loss: The net loss recorded for the same period stood at $(164.3) million, translating to $(0.19) per diluted share.

Revenue Breakdown by Business Units:

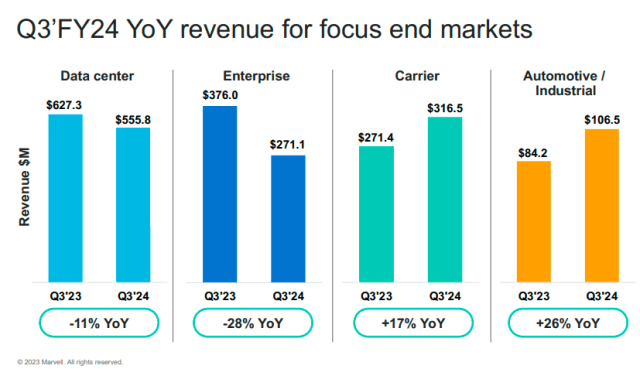

Data Center: Achieved $556 million in revenue, boasting a robust 21 percent quarter-on-quarter (QoQ) growth. Notably, cloud-related revenue surged by over 30 percent QoQ.

Enterprise: Witnessed a decline of 17 percent QoQ, reflecting subdued market demand.

Carrier: Generated $317 million in revenue, showcasing a commendable 15 percent QoQ increase, attributed primarily to Marvell’s 5G product cycle.

Automotive / Industrial: Earned $107 million in revenue, experiencing a marginal 3 percent QoQ decline.

Key Insights from Marvell’s CEO, Matt Murphy:

Matt Murphy, Chairman and CEO of Marvell, highlighted the company’s strategic strengths, emphasizing the diversified portfolio. He stated, “Revenue from our data center end market grew over 20 percent sequentially in the third quarter, and we expect growth of over 30 percent sequentially in our fourth quarter.”

Projections for Fourth Quarter of Fiscal 2024:

Looking ahead, Marvell Technology aims for continued growth, targeting revenue of $1.420 billion for the fourth quarter. Additionally, the company anticipates a gross margin range between 48.2 percent to 50.7 percent.