Smartphone panel shipments are projected to decline by 1.7 percent to 2.032 billion units in 2025, driven by a slight reduction in demand for second-hand devices.

The smartphone market is expected to grow by 3 percent in 2024. The market for refurbished and second-hand smartphones is driving growth in the smartphone panel market, with shipments estimated to increase by 6.7 percent to 2.066 billion units.

Major Panel Suppliers:

BOE remains the global leader in smartphone panel shipments, with a 2.8 percent growth projected in 2025.

Samsung Display benefits from Apple’s demand for AMOLED panels, but its shipments may decline by 3.1 percent in 2025 due to Apple’s supplier diversification.

HKC is seeing rapid growth, expected to increase shipments by 4.8 percent in 2025.

CSOT is forecast to grow significantly, with a 62.9 percent YoY increase in 2024, benefiting from its strong partnership with Xiaomi.

Tianma maintains stable shipments, benefiting from the shift towards AMOLED technology.

Panel Type Trends:

AMOLED panels continue to see strong demand, contributing to high utilization rates for leading suppliers.

Demand for LTPS LCD panels is weakening, particularly in mid- to low-end devices.

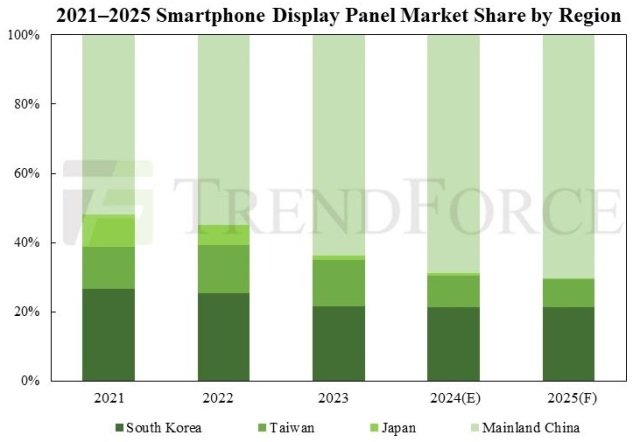

Taiwanese panel makers are losing market share in the a-Si LCD segment due to HKC’s rapid growth.

Japanese panel makers are exiting the smartphone market, leading to a steady decline in their market share.

Korean panel makers retain an edge in the high-end market due to advanced AMOLED technology.

Chinese panel makers are expanding their share in both the mid- to high-end AMOLED and low-end a-Si LCD markets, and are expected to dominate with a 68.8 percent global market share in 2024, potentially rising above 70 percent in 2025, TrendForce said.