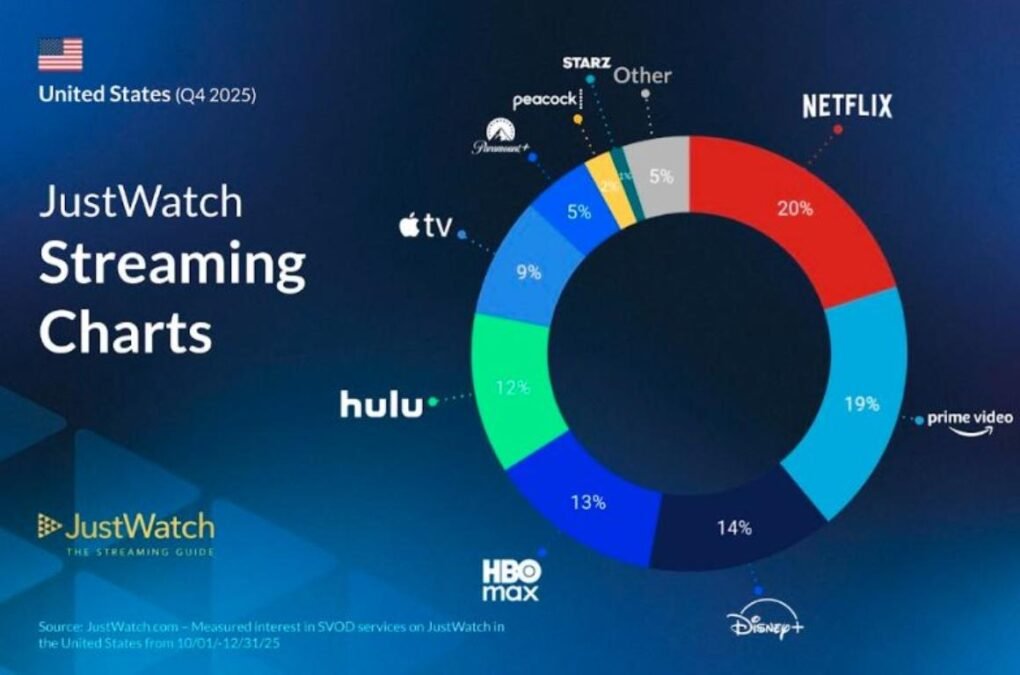

According to JustWatch data, Netflix emerged as the new market leader in the fourth quarter of 2025 with a 20 percent share, overtaking Amazon Prime Video, which slipped to 19 percent. Netflix gained 1 percentage point quarter over quarter, while Prime Video lost 1 percentage point during the same period.

On an annual basis, both leading platforms lost ground amid intensifying competition. Netflix declined by 1 percentage point year over year, while Prime Video recorded a sharper drop of 3 percentage points from Q4 2024 to Q4 2025.

Netflix’s strong Q4 performance was supported by high engagement across both movies and series. Exclusive titles such as Frankenstein and Stranger Things consistently topped the weekly JustWatch US Streaming Charts, helping the platform regain momentum despite growing competition from mid-tier services.

Mid-Tier Platforms Gain Momentum in 2025

The JustWatch report highlights increasing competition across the SVOD landscape, with several mid-tier platforms posting notable gains in 2025. Disney+, Apple TV+, and smaller services collectively emerged as the biggest winners of the year.

Disney+ increased its US market share to 14 percent, gaining 2 percentage points year over year and becoming the third-largest streaming service in the country. Apple TV+ also added 2 percentage points to reach a 9 percent share, reflecting its growing mainstream appeal. Other smaller platforms together rose to 5 percent, up 2 percentage points over the year.

These gains came largely at the expense of the two market leaders, underscoring a gradual shift toward a more fragmented and competitive streaming ecosystem.

Disney+ and Hulu Strengthen Their Positions

Disney+ remained stable quarter over quarter in Q4 2025, while Hulu gained 1 percentage point to reach a 12 percent market share. Over the full year, Disney+ delivered one of the strongest performances in the market, surpassing HBO Max in March to secure third place overall, according to JustWatch data.

Hulu also recorded steady progress, adding 1 percentage point year over year and narrowing the gap with HBO Max. Both platforms benefited in 2025 from exclusive series such as Alien: Earth and Andor, as well as major releases including Lilo & Stitch released in 2025. While their presence in the JustWatch Streaming Charts was less frequent in Q4, Disney’s broader content ecosystem gained visibility through strong theatrical releases like Zootopia 2 and Avatar: Fire and Ash.

HBO Max Holds Steady as Apple TV+ Continues to Rise

HBO Max maintained a stable 13 percent share in Q4 2025 and showed no significant change year over year. However, it lost its top three ranking earlier in the year as Disney+ continued to expand. Engagement on HBO Max remained strong, driven by popular series such as The Last of Us, which ranked as the platform’s most popular title of 2025, alongside films like Sinners.

Apple TV+ gained 1 percentage point in Q4 and ended the year with a 9 percent share. Its annual increase of 2 percentage points reflects growing traction with high-performing originals such as Severance and the Q4 hit Pluribus, which ranked prominently on the JustWatch Streaming Charts.

Challenges for Paramount+ and Smaller Services

Paramount+ faced a challenging year, ending Q4 2025 with a 5 percent market share after losing 1 percentage point during the quarter and 4 percentage points year over year. The decline may be partly linked to the conclusion of Yellowstone, which aired its series finale in late 2024. Despite this, the platform saw strong engagement from select exclusives, including MobLand, South Park, and The Naked Gun.

Peacock Premium held steady at 2 percent in Q4 and gained 1 percentage point over the year, while Starz remained stable at 1 percent. Other smaller platforms collectively grew by 1 percentage point quarter over quarter but declined by 2 percentage points on an annual basis.

US Streaming Market Outlook

The JustWatch Q4 2025 report underscores a clear trend toward intensifying competition in the US streaming market. While Netflix and Prime Video continue to dominate, their gradual loss of share highlights the growing influence of mid-sized platforms with strong original content strategies. As user preferences continue to evolve, 2026 is likely to see further shifts as platforms compete for attention through exclusives, franchises, and differentiated viewing experiences.

BABURAJAN KIZHAKEDATH