The Chinese streaming market stands out due to investment in 5G mobile network, its massive scale, consolidation, and isolation from the global streaming ecosystem.

Streaming market in China

In early 2024, the streaming market in China was dominated by local platforms, with the top services all originating from China, according to BB Media Research.

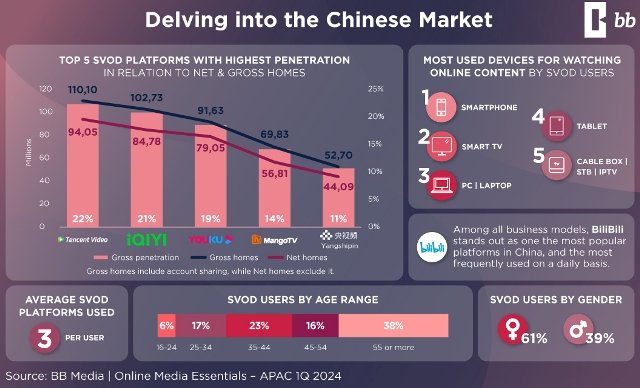

Tencent Video is the largest player in the China streaming market with household penetration of 110.10 million. Tencent Video has reported a decline in streaming revenue in Q2 2024.

iQIYI is in the second position with household penetration of 102.73 million. Baidu’s iQIYI reported an approximately 32 billion yuan of total annual revenue in 2023.

YouKu is in the third position with household penetration of 91.63 million. In February 2024, Alibaba wrote down $1.2 billion of goodwill on Youku, its video-streaming operation.

MangoTV is holding the fourth position in China with household penetration of 69.83 million. Mango TV’s revenue from its online video business in 2023 was around 10.6 billion yuan

Yangshipin is the fifth largest streaming company with household penetration of 52.70 million.

These platforms boast impressive market penetration, with the top three commanding between 19 percent and 22 percent of the market share. Interestingly, account sharing rates in China are among the lowest in the region, ranging from 14 percent to 17 percent, with Mango TV topping the list at 19 percent.

Smartphone growth

Chinese consumers favor smartphones for streaming content, driven by affordable mobile data plans.

China is expected to have 1.18 smartphone customers at the end of 2026. China’s 5G subscriber base has reached 1.15 billion in August 2024.

Canalys estimates that tech companies — led by local firms — have shipped 70 million (up 10 percent) smartphones to China in the second-quarter of 2024. Vivo, Oppo, Honor, Huawei, and Xiaomi are the leading smartphone brands in China.

5G market

GSMA report said China’s 5G market is set to add almost $260 billion to the Chinese economy in 2030 with connections set to top 1 billion in 2024. Mobile data traffic in China is expected to quadruple by the end of the decade.

China’s 5G market is more than three times the size of the next largest market, the United States, thanks to significant investment in 5G mobile networks. China Mobile leads the telecom sector, followed by China Telecom and China Unicom, emphasizing the importance of mobile accessibility for streaming platforms.

In 2023, China Mobile, for instance, spent nearly $11.68 billion in mobile infrastructure to enhance its 5G network coverage. Sarwat Zeeshan, Telecom Analyst at GlobalData, said: “China Mobile announced plans to expand 5G-A to over 300 cities in 2024, with the goal of establishing the world’s largest 5G commercial network.”

International streaming platforms

International streaming platforms face significant challenges entering this market. Strict regulations mandate partnerships with local media, and China’s stringent censorship rules can further complicate entry. Despite these barriers, the Chinese market presents a potential growth opportunity for local streaming services, with the possibility of extending their reach regionally and globally.

Baburajan Kizhakedath