China’s multi-play service sector is anticipated to witness steady growth over the coming years, with revenues expected to rise at a compound annual growth rate (CAGR) of 1 percent.

According to GlobalData, multi-play service revenues in China are projected to increase from $172.7 billion in 2023 to $181.5 billion in 2028. This growth is attributed to telecom operators’ strategic focus on offering triple-play and quad-play service bundles, leveraging robust fixed network infrastructure to promote high-speed internet services.

According to GlobalData, multi-play service revenues in China are projected to increase from $172.7 billion in 2023 to $181.5 billion in 2028. This growth is attributed to telecom operators’ strategic focus on offering triple-play and quad-play service bundles, leveraging robust fixed network infrastructure to promote high-speed internet services.

The number of multi-play household subscriptions in China is expected to increase from 474.4 million in 2023 to 505.2 million in 2028. This surge is primarily fueled by the adoption of triple-play and quad-play service bundles.

China has a well-established fixed network infrastructure and relatively high fixed broadband household penetration. Hence, telcos are well-positioned to promote multi-play service bundles centered around high-speed internet services.

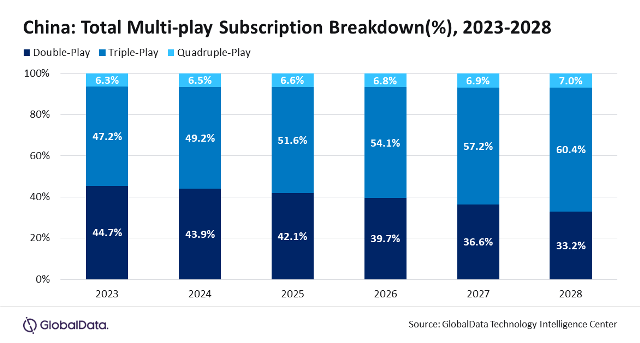

Sarwat Zeeshan, Telecom Analyst at GlobalData, said: “While double-play service plans will dominate the majority of multi-play households during the forecast period, their subscriber volume is expected to decline steadily. Conversely, the share of total multi-play households opting for triple-play and quad-play services will witness growth through 2028.”

The monthly household spend on multi-play bundles is anticipated to decline over the forecast period, mainly due to decreases in double-play and triple-play average revenue per user (ARPU). However, the average monthly household spend on quad-play bundles is forecasted to increase from $44.90 in 2023 to $56.33 in 2028, driven by the expanding penetration of fixed mobile convergence households, expected to surge from 16 percent in 2023 to 41 percent in 2028.

China Mobile is poised to lead the multi-play market in terms of household subscriptions up to 2028. The operator is capitalizing on its fiber-to-the-home (FTTH) networks to expedite the adoption of multi-play services, with a keen focus on reducing churn and augmenting revenue-generating units (RGUs).

TelecomLead.com News Desk