A report prepared by Angela Medez, senior market analyst, Client Devices, IDC, has revealed the latest smartphone market trends in the Philippines.

The Philippines smartphone market saw a 6.1 percent growth in 2024, reaching nearly 18 million units. Despite economic challenges like a weakening peso and severe weather, the market remained resilient due to economic stability and the influx of budget-friendly models.

More than half of the shipments in 2024 were priced under $100, with Transsion brands (Infinix, Tecno, and Itel) contributing over 4.8 million units in the Philippines.

The overall average selling price (ASP) dropped from $192 in 2023 to $179 in 2024. Infinix’s Smart series and Tecno’s Spark Go series were key drivers in the budget segment. The market saw a slowdown in the last quarter, with an 11.8 percent annual decline due to early vendor launches but still recorded nearly 5 million shipments during the holiday season.

Entry-level smartphones dominated the Philippines market, catering to budget-conscious consumers. Mid-range and premium segments struggled due to cautious spending and a focus on affordability. Local and international brands continued aggressive pricing strategies to maintain competitiveness.

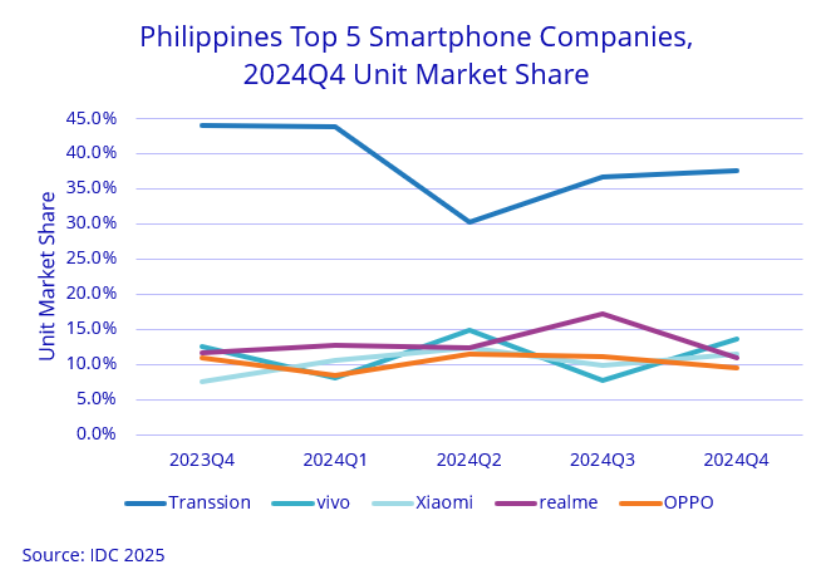

In the Philippines smartphone market for 2024, Transsion dominated with a 37.3 percent market share, increasing from 34.1 percent in 2023. Realme ranked second but saw a decline from 15.9 percent to 13.3 percent.

Vivo and Xiaomi tied for third place, both holding an 11.0 percent market share. Vivo experienced a slight drop from 11.3 percent in 2023, while Xiaomi grew from 9.7 percent.

OPPO secured the fifth spot with in the Philippines a 10.1 percent share, down from 12.2 percent the previous year. Other brands collectively accounted for 17.4 percent of the market, an increase from 16.7 percent. The IDC data highlights Transsion’s significant growth, while other major brands faced minor declines or modest gains in the Philippines.

The overall market for the Philippines outlook remains positive, with further growth expected as demand for affordable smartphones continues.