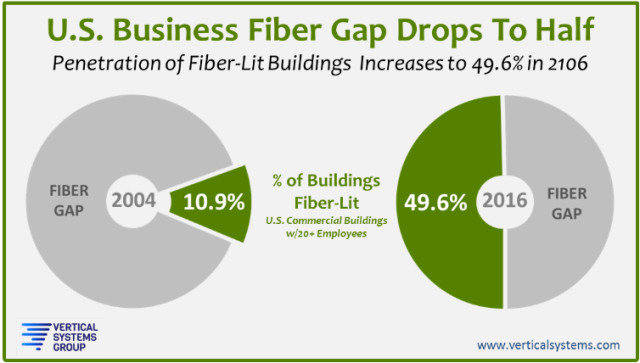

Business fiber penetration in commercial buildings in the U.S. increased to 49.6 percent, according to latest research from Vertical Systems Group.

Business fiber penetration in commercial buildings in the U.S. increased to 49.6 percent, according to latest research from Vertical Systems Group.

This benchmark figure quantifies fiber-lit multi-tenant and company-owned buildings in the U.S. with twenty or more employees. The Fiber Gap, which refers to the remaining commercial buildings with no access to optical fiber facilities, has dropped to 50.4 percent in 2016 from nearly 90 percent in 2004.

ALSO READ: Business fiber penetration in US

The report said active optical fiber is the most widely deployed access technology for the delivery of Carrier Ethernet services in the U.S. Fiber access is also preferred by service providers and business customers for higher speed dedicated connectivity to the Internet, Cloud services, data centers, hybrid VPNs, and emerging SDN-enabled services.

“Fiber footprints have been highly valued assets in nearly every merger transaction in the industry during the past two years. The density of fiber lit buildings on-net and geographic reach are significant competitive differentiators,” said Rosemary Cochran, principal at Vertical Systems Group.

Network providers report that fiber footprint expansion is the top factor that will drive Carrier Ethernet growth and support rising demand for other gigabit-speed services.

Meanwhile, AT&T, Verizon, CenturyLink, and Windstream have gained a position on the 2016 U.S. Incumbent Carrier Ethernet LEADERBOARD, according to Vertical Systems Group’s latest research.

“Retail Ethernet services sold by Incumbent Carriers grew 7 percent in the second half of 2016, trending lower than in the first half,” said Rick Malone, principal at Vertical Systems Group.

Major carrier Ethernet providers continued to virtualize operations functions and improve service delivery cycles to improve profitability.