The fixed communications services revenue in China will achieve a compound annual growth rate (CAGR) of 1 percent reaching $302 billion by 2028 from $288 billion in 2023 – due to the adoption of fixed broadband services across the nation.

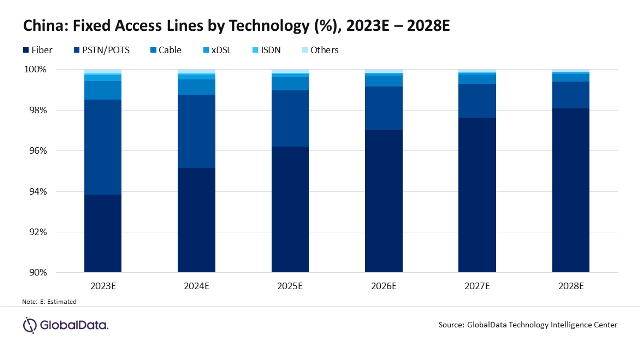

Fiber optic technology in China is anticipated to maintain its dominance in the market until 2028. This projection comes amidst a decline in fixed voice telephony lines, expected to diminish at a CAGR of 2.7 percent over the 2023-2028 period, as consumers increasingly gravitate towards mobile and internet-based communication alternatives.

Fiber optic technology in China is anticipated to maintain its dominance in the market until 2028. This projection comes amidst a decline in fixed voice telephony lines, expected to diminish at a CAGR of 2.7 percent over the 2023-2028 period, as consumers increasingly gravitate towards mobile and internet-based communication alternatives.

There will be a downward trend in the average revenue per user (ARPU) for fixed voice services in both residential and business segments in China. It is estimated that ARPU levels will decrease from $5.87 to $5.03 for residential users and from $17.41 to $11.97 for businesses between 2023 and 2028, signaling a significant reduction in total fixed voice service revenues in China.

Fiber technology is poised to remain the preferred choice for broadband subscriptions in China, driven by ongoing expansions and enhancements in the fiber network infrastructure throughout China.

Notably, China’s Ministry of Industry and Information Technology (MIIT) disclosed that as of February 2023, approximately 110 cities in the country have been equipped with gigabit fiber networks in China, showcasing a substantial increase from 81 cities in the preceding year.

In terms of market leadership, China Mobile emerged as the frontrunner in the fixed broadband services sector in 2023, boasting the largest subscription share. This position was followed by China Telecom and China Unicom.

According to GlobalData’s China Fixed Communication Forecast for the fourth quarter of 2023, China Mobile is poised to maintain its dominance in the market through 2028. This dominance is attributed to the company’s stronghold in the fiber-to-the-home (FTTH) segment and its strategic deployment of promotional discount offers on broadband and multi-play plans.