Global shipments of cellular IoT modules, excluding automotive embedded and telematics modules, experienced a 3 percent year-on-year decline in the second quarter of 2023.

This downturn can be attributed to a combination of reduced demand and weakened economic sentiments affecting various market segments, Counterpoint’s latest Global Cellular IoT Module and Chipset Tracker by Application report said.

This downturn can be attributed to a combination of reduced demand and weakened economic sentiments affecting various market segments, Counterpoint’s latest Global Cellular IoT Module and Chipset Tracker by Application report said.

With the exception of the top three applications – smart meters, point of sale (POS) devices, and automotive – most segments witnessed a significant drop in shipments. These top three applications collectively constituted approximately 51 percent of the market in Q2 2023. Remarkably, India emerged as the only market to register positive growth in shipments during this quarter, the report said.

“In Q2 2023, many module players experienced declines in shipments, marking the first contraction since the onset of the COVID-19 pandemic. The initial surge in demand for connected devices due to the pandemic is waning, while digital transformation efforts in industrial and other vital sectors have not yet translated into increased shipments,” Mohit Agrawal, Associate Director at Counterpoint, said.

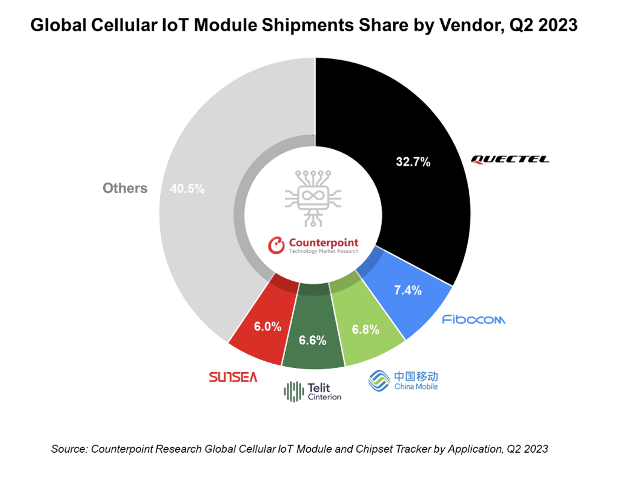

Quectel, a leading module vendor, witnessed a decline in market share due to weakened demand. Additionally, Chinese module vendors are facing increased scrutiny by the US for security concerns, potentially challenging their global expansion plans and creating opportunities for other vendors.

In a notable shift, China Mobile performed strongly in smart meter, POS, and asset tracker applications, surpassing Telit Cinterion to become the third-largest player in the global cellular IoT module market. Telit Cinterion faced challenges amidst the market downturn but is looking to boost its presence by partnering with VVDN to manufacture IoT modules in India, anticipating the country’s potential as the fastest-growing market by 2030.

Looking ahead, Soumen Mandal, Senior Research Analyst at Counterpoint, provided insights into the future outlook, stating, “IoT module shipments for the entire year of 2023 are expected to remain level compared to 2022. The market is showing early signs of recovery in H2 2023, improving its performance from H1 2023. However, lower demand is influencing the market’s long-term growth trajectory, shifting current demand by 2-3 years.”

The adoption of 5G technology has been slower than expected due to higher costs, coverage issues, and maturity of the 5G device ecosystem. Anticipated to be an industry game-changer, the upcoming 5G RedCap offers a more affordable solution and is expected to witness early adoption, particularly in POS and router / CPE applications.