The Trump Administration’s move to bar Huawei from sourcing American technology has ramifications for not only the Chinese technology giant but also the key suppliers in the U.S.

IHS Markit analyst comments that companies like Micron and Western Digital, two major chip and storage device suppliers to Huawei, are severely impacted by the U.S. government’s move to ban the Chinese firm on alleged security reasons.

Although the U.S. government has eased restrictions on Huawei, allowing existing client relationships to continue largely uninterrupted for 90 days, the ban already caused Micron and Western Digital to suspend sales to the Chinese company.

“The implications of the Huawei ban are quite serious for Micron and Western Digital,” said Michael Yang, research and analysis director at IHS Markit. “When you lose the world’s largest mobile infrastructure equipment supplier and the second-biggest smartphone maker as a customer, it’s going to have a major impact.”

This event is having a major impact on the two U.S. companies’ direct sales. It also has affected their indirect sales, prompting the companies to ensure their wares aren’t incorporated into any products sold to Huawei by their customers, IHS report says.

Earlier, device component makers like Intel, Qualcomm and Broadcom also announced their difficulty in supplying to the Chinese firm.

Recently Huawei reportedly halted its plan to unveil a new laptop in the U.S. Officials who responded to media query stated that they are “unable to supply the PC” in the current scenario and the decision will depend on how long the company will remain in the black list of the U.S. Department of Commerce.

The inability of the firm to procure components could also be one among the reasons, cite experts.

BBC reports that Washington’s intervention has resulted in some non-US companies also adopting anti-Huawei approach. ARM, which is UK-based and owned by Japan’s Softbank, recently decided to suspend business with Huawei.

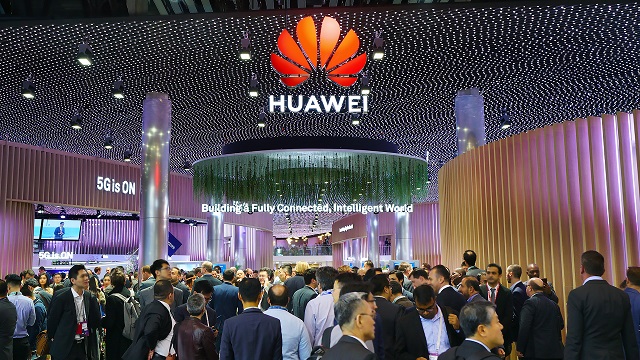

Huawei in recent years has carved out prominent positions in the global smartphone and mobile infrastructure markets.

In 2018, Huawei rose to take second place in the smartphone business, with 206.1 million shipments, according to the IHS Markit Smartphone Intelligence Service. This put it just slightly ahead of Apple, at 204.7 million.

The company in 2017 became the leader in the worldwide mobile infrastructure equipment market, surpassing Ericsson. Huawei has retained the top position and rose to account for nearly one-third of the market, with a 31 percent share of global revenue in 2018, as reported by the IHS Markit Mobile Infrastructure Intelligence Service.

Huawei’s market position has translated directly into purchasing power, with the company ranking as the world’s fourth-largest OEM semiconductor buyer in 2018.

The company spent $15.9 billion on semiconductors in 2018, according to the IHS Markit OEM Semiconductor Spending & Design Activity Intelligence Service. Memory represents a considerable slice of that spending, with the company buying $1.7 billion worth of DRAM and $1.1 billion worth of NAND flash memory for the year.

The revolt from the U.S. could also mean a windfall opportunity for non-U.S suppliers. Though Huawei is likely to face some interruption in supply but eventually should be able to line up new supplies from leading DRAM and NAND suppliers like Samsung, SK Hynix, Toshiba, IHS report said.

While the ban was ostensibly designed to penalize Huawei and benefit the U.S. tech industry, the reality is the pain will be felt by companies on both sides of the Pacific, affecting key U.S. suppliers along with Huawei.