India’s fixed broadband market is poised for steady growth, with fixed communication services revenue expected to increase at a CAGR of 5.2 percent from $12.8 billion in 2024 to $16.5 billion by 2029.

This growth will be largely driven by rising consumer demand for high-speed, content-rich internet services and the ongoing expansion of fiber broadband and Fixed Wireless Access (FWA) networks by key operators.

While fixed voice revenue is projected to decline at a CAGR of 1.7 percent due to falling ARPU and the shift to mobile and OTT-based communications, fixed broadband services will expand at a CAGR of 5.7 percent.

Fiber broadband will play a central role, with fiber optic lines expected to account for 94 percent of all broadband connections by 2029. This growth is supported by continued government investment in digital infrastructure and aggressive FTTH rollouts by major operators.

The market is transitioning into a new digital era marked by faster internet speeds, bundled services, and deeper rural penetration. Strategic pricing, digital content access, and infrastructure modernization will be key to sustaining momentum and bridging the digital divide in the years ahead.

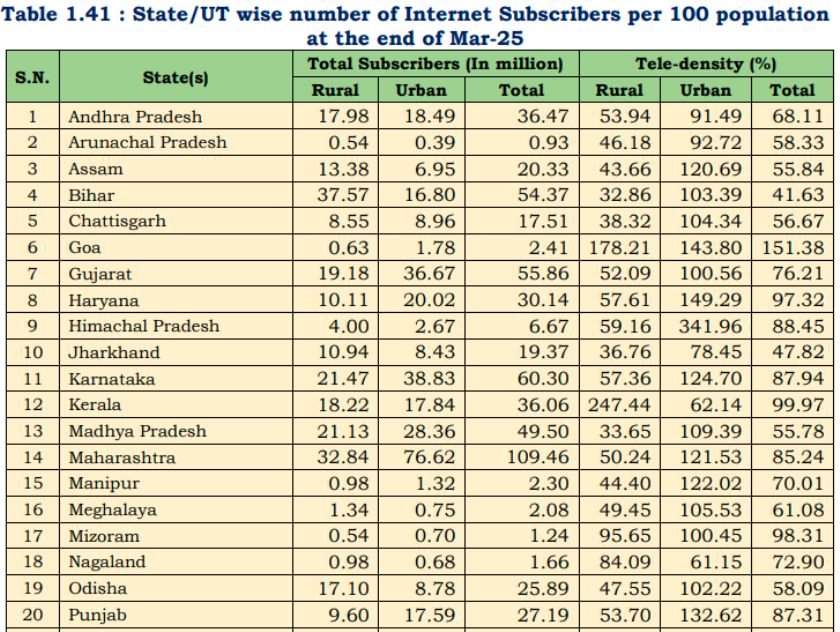

India’s broadband landscape as of March 2025 includes a total of 944.12 million subscribers, comprising 927.70 million wireless and 41.41 million wired internet users. Urban areas account for 561.42 million internet subscribers, while rural areas have 407.69 million. The country hosts 55,052 public Wi-Fi hotspots, which collectively consumed 14,329 terabytes of data, TRAI said recently.

In the wired internet segment, Reliance Jio leads with 11.48 million subscribers (27.72 percent market share), followed by Bharti Airtel with 8.55 million (20.66 percent), BSNL with 10.51 percent, Atria at 5.53 percent, and Kerala Vision with 3.15 percent. The top five regions by broadband subscriptions are Maharashtra (78.21 million), U.P.-East (77.01 million), Bihar (72.29 million), Andhra Pradesh (71.10 million), and Madhya Pradesh (66.13 million).

The June-2025 edition of the Ericsson Mobility Report indicated that Jio reported an eight-fold increase in 5G FWA connections from March 2024 to March 2025, reaching a total of 5.6 million connections, targeting 100 million connected homes in India.

Jio is set to dominate the fixed broadband market by subscription share, driven by its expanding fiber network and growing AirFiber FWA offerings. Bharti Airtel is also strengthening its presence with similar investments.

Indian telecom operators are employing competitive pricing strategies and bundling OTT content to attract subscribers. For instance, Jio’s ₹999/month broadband plan offers 150 Mbps speed with access to 15 major streaming platforms.

Airtel offers a range of high-tier fixed broadband plans catering to customers seeking faster speeds and bundled entertainment. The ₹899 per month plan provides 100 Mbps unlimited internet along with approximately 350 TV channels and access to OTT content. The ₹999 to ₹1199 per month plans also offer 100 Mbps speeds, with added benefits such as subscriptions to Netflix, Amazon Prime, Apple TV+, Google One, and DTH services. For heavier internet users, the ₹1599 per month plan delivers 300 Mbps speeds combined with both OTT and TV content bundles.

Baburajan Kizhakedath