Fixed communication services revenue in Australia is anticipated to see sluggish growth, reaching $7.8 billion by 2028 from $7.5 billion in 2023, with a compound annual growth rate (CAGR) of 0.8 percent, according to the latest analysis from GlobalData.

The report suggests that while revenue from fixed voice services is set to decline, there will be a slight compensatory increase in revenue from fixed broadband services over the forecast period.

Srikanth Vaidya, Telecom Analyst at GlobalData, attributes the decline in fixed voice service revenue in Australia to a drop in the overall fixed voice average revenue per user (ARPU) levels, as subscribers increasingly gravitate towards mobile and over-the-top (OTT) communication services.

Fixed broadband service revenue in Australia is expected to experience marginal growth at a CAGR of 1 percent. This growth will primarily be fueled by the steady expansion of fiber-to-the-home/business (FTTH/B) subscriptions, bolstered by government-led coverage expansions.

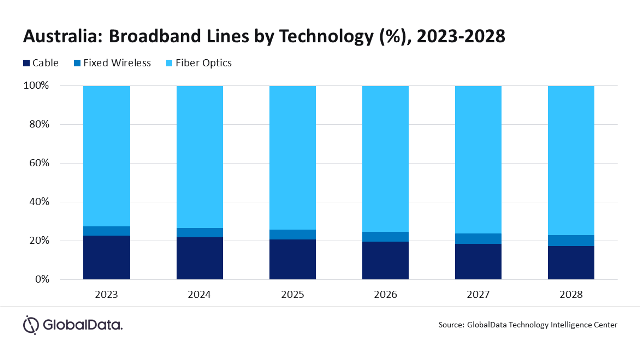

Fiber lines accounted for a majority 71.6 percent share of the total fixed broadband lines in Australia in 2023, which will increase to 76.1 percent in 2028. This growth will be supported by the rising demand for high-speed Internet services in the country and the government’s focus on aggressive fiber network expansion nationwide under the National Broadband Network (NBN) project.

The National Broadband Network (NBN) project has made significant strides in Australia, with over 6.90 million premises connected by June 2023, offering access to nbn Home Ultrafast internet with speeds ranging from 500 Mbps to 1 Gbps. Furthermore, NBN aims to extend the Fibre to the Node (FTTN) to Fibre to the Premises (FTTP) network upgrade program to approximately 3.5 million premises by the end of 2025.

Telstra has dominance in both the fixed voice services and fixed broadband markets due to its strong presence in the VoIP segment and its proactive approach towards expanding fiber network coverage. Telstra’s promotion of cost-effective multi-play plans is also expected to contribute to its leadership position in the market through 2028.