Semiconductor equipment maker ASML Holding said its revenue rose 91 percent to 6.74 billion euros with net profit of 1.96 billion euros ($2.15 billion) during January-March 2023.

The outlook for ASML remains strong despite belt-tightening among its client base. ASML maintained a forecast for 25 percent sales growth this year, with sales of between 6.5 billion and 6.7 billion euros in the second quarter of 2023. ASML expects R&D costs of around €990 million and SG&A costs of around €275 million for 2023.

The outlook for ASML remains strong despite belt-tightening among its client base. ASML maintained a forecast for 25 percent sales growth this year, with sales of between 6.5 billion and 6.7 billion euros in the second quarter of 2023. ASML expects R&D costs of around €990 million and SG&A costs of around €275 million for 2023.

“Demand still exceeds our capacity for this year and we have an order backlog of over 38.9 billion euros,” ASML CEO Peter Wennink said in a statement.

ASML plays a key role in the semiconductor industry because it dominates the market for lithography equipment used to create the minute circuitry of chips.

ASML has struggled to meet demand as top customers TSMC, Samsung and Intel continue to spend billions on expansion.

ASML CFO Roger Daasen said some major companies were delaying the timing of their demand for certain tools but others were happy to take over their orders.

ASML CFO Roger Daasen said some major companies were delaying the timing of their demand for certain tools but others were happy to take over their orders.

“For memory customers, we do see them limiting their Capex and we see some of that behaviour also in certain segments of logic,” he said.

ASML Holding expects sales to mainland China to pick up for the remainder of 2023 following a dip in the first quarter.

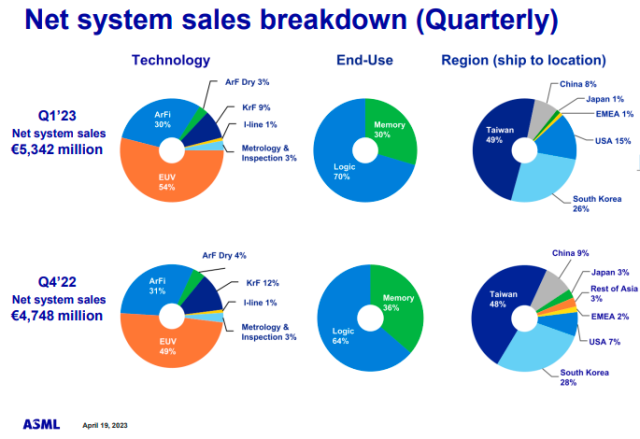

ASML’s sales in mainland China, its third biggest market after Taiwan and South Korea, have been the subject of a high profile geopolitical tug-of-war.

Domestic China accounts for more than 20 percent in its backlog, despite a dip in first quarter sales to about 8 percent of the company’s total.